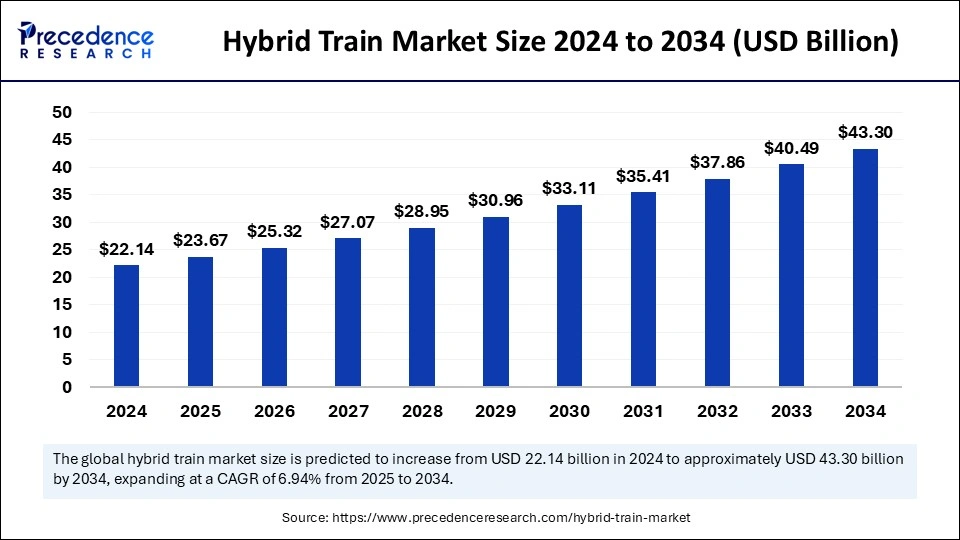

The global hybrid train market size was evaluated at USD 22.14 billion in 2024 and is predicted to hit around USD 43.3 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034.

The hybrid train market is surging as countries prioritize sustainable, energy-efficient transport. Driven by stricter emissions rules and environmental awareness as hybrid trains are swiftly replacing diesel models. Innovative technologies like regenerative braking and advanced energy storage are significantly enhancing the efficiency and appeal of hybrid trains, making them a compelling alternative to traditional diesel models.

Coupled with strong government incentives and supportive green policies particularly in the Asia Pacific region, these advancements are accelerating the adoption of hybrid trains and driving momentum in the market. While expanding rail networks fuel growth, limited infrastructure in some regions poses a challenge to long-term success.

Hybrid Train Market Key Takeaways

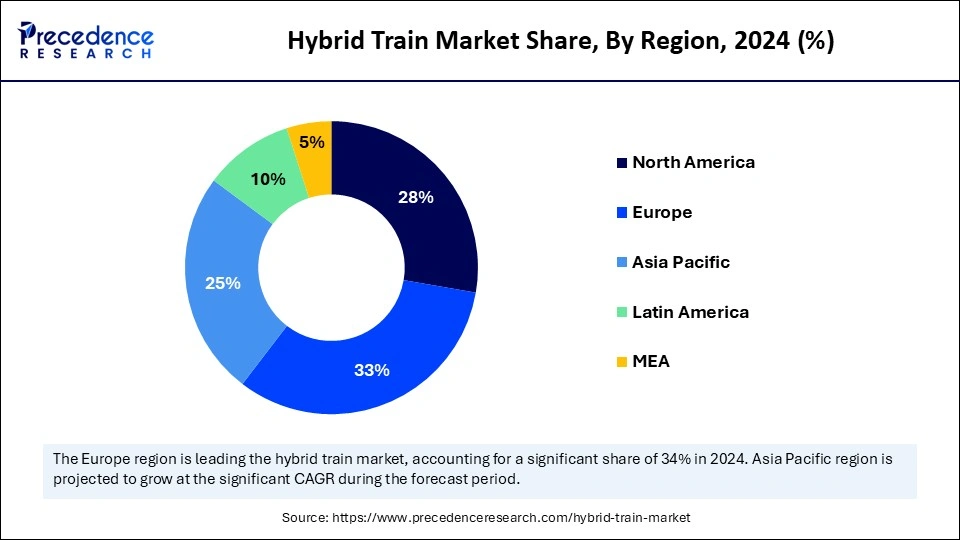

- Europe dominated the hybrid train market with the largest share of 33% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By propulsion type, the electro-diesel segment contributed the biggest market share of 39% in 2024.

- By propulsion type, the battery electric segment is expected to witness significant growth between 2025 and 2034.

- By speed, the above 200 km/h segment led the market in 2024.

- By speed, the 100-200 Km/h segment is expected to grow at a rapid pace in the coming years.

- By application, the passenger segment dominated the market in 2024.

- By application, the freight segment is anticipated to expand at a significant growth rate over the studied period.

Hybrid Train Market Regional Outlook

In 2024, The global hybrid train market size was calculated at USD 22.14 billion and expanding at a CAGR of 6.94% from 2025 to 2034. Europe dominated the hybrid train market by capturing the largest share of 33% in 2024. Europe’s hybrid train market is thriving due to its strong focus on eco-friendly transportation and advanced rail infrastructure.

Stringent EU regulations aimed at cutting carbon emissions have accelerated hybrid train adoption. The region’s commitment to decarbonization and green mobility has led to early implementation of hybrid propulsion systems. Additionally, government collaborations with leading rail manufacturers have driven innovation, positioning Europe as a global leader in hybrid rail technology.

Asia Pacific is expected to expand at the highest CAGR in the upcoming period with 25 % market share in 2024. North America is observed to grow at a considerable growth rate with market share of 28% in the coming years. Although Latin America with market share of 10% and the Middle East & Africa (MEA) contributes market share of 5% respectively they show steady growth, driven by improving economic conditions and rising consumer demand.

What is the Europe Hybrid Train Market Size?

The Europe hybrid train market size was evaluated at USD 7.31 billion in 2024 and is projected to be worth around USD 14.51 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

Hybrid Train Market Trends

Technological Advancements

- Battery Innovations: Advanced lithium-ion and solid-state batteries are enhancing energy storage, efficiency, and range, making hybrid trains more reliable and cost-effective for various routes.

- Hydrogen Fuel Integration: Countries like Germany and India are exploring hydrogen-powered trains to support decarbonization efforts, offering zero-emission alternatives for cleaner transportation.

- Regenerative Braking Systems: Hybrid trains are increasingly adopting regenerative braking technology, which recovers energy during braking and converts it into electricity, improving energy efficiency and lowering operational costs.

Environmental and Regulatory Drivers

- Emission Reduction Initiatives: Tightening emissions regulations, especially in Europe and North America, are accelerating the adoption of hybrid trains. Governments are incentivizing rail operators to transition from diesel-powered to hybrid and electric models to meet sustainability targets.

- Government Incentives: Various government subsidies, grants, and green policies are supporting the development and deployment of hybrid trains. Public-private partnerships are also helping bring innovative hybrid technologies to market.

Operational Flexibility

- Electro-Diesel Technology: Electro-diesel trains, capable of operating on both electrified and non-electrified tracks, are growing in popularity. This flexibility makes them ideal for regions with partial or no rail electrification, offering a cost-effective solution for diverse rail networks.

- Urban and Intercity Expansion: Hybrid trains are increasingly being deployed in urban and intercity networks, where demand for efficient, environmentally friendly public transport is growing. The focus is on reducing emissions in densely populated areas.

Digitalization and Smart Management

- Smart Energy Systems: The integration of IoT, AI, and advanced analytics into hybrid train operations is improving energy management. These smart systems help optimize power usage, monitor train conditions, and reduce downtime through predictive maintenance.

- Real-time Monitoring and Maintenance: Digital platforms for real-time tracking and performance monitoring are helping operators reduce fuel consumption, cut emissions, and enhance train reliability, leading to more sustainable and cost-effective operations.

Global Expansion and Infrastructure Investments

- Infrastructure Upgrades: As governments and private players invest heavily in modernizing rail infrastructure, hybrid trains are becoming an integral part of this upgrade, particularly in Europe, Asia Pacific, and North America.

- Urbanization and Population Growth: The growing need for efficient public transportation due to rapid urbanization, particularly in Asia Pacific, is driving demand for hybrid trains as a solution for high-capacity, sustainable travel.

Propulsion Type Outlook

In 2024, the electro-diesel segment led the hybrid train market due to its versatile dual-power capability, allowing operation on both electrified and non-electrified routes. This flexibility makes it ideal for regions with partial electrification, ensuring uninterrupted service across varied infrastructure. Its widespread adoption is driven by lower fuel consumption compared to traditional diesel, compatibility with existing rail systems, and minimal infrastructure requirements—making it a cost-effective modernization solution. The ability to switch between power modes also enhances operational range in remote areas while reducing emissions in urban zones, positioning electro-diesel as the preferred choice during the current transport transition phase.

Battery electric segment is projected to grow rapidly, fueled by technological advancements and a global push for sustainability. These systems offer zero-emission operations, reduced maintenance, and quiet performance—ideal for densely populated areas. Growth is further supported by the expansion of charging infrastructure, stricter environmental regulations, and rising investments in fast-charging and battery life improvements. As renewable energy becomes more integrated into national grids, battery electric trains are emerging as a clean, future-ready solution for urban and regional rail networks.

Speed Outlook

The above 200 km/h segment dominated the hybrid train market in 2024, driven by the rising demand for high-speed transit networks that improve intercity connectivity and significantly reduce travel time. This segment includes advanced train models designed for rapid acceleration and optimal performance over long distances. These high-speed trains are preferred for their ability to ease traffic congestion, lower carbon emissions, and deliver a premium travel experience. The segment’s leading position is further supported by substantial investments in dedicated high-speed corridors and modern rail infrastructure.

The 100–200 km/h segment is anticipated to experience rapid growth in the coming years. This speed range offers a practical balance of infrastructure adaptability, operational efficiency, and travel speed. It caters to growing commuter demand for faster, reliable mid-range transportation solutions without the high costs associated with ultra-high-speed systems. Trains operating within this range are well-suited for regional and suburban routes, as they can integrate with existing rail infrastructure. The increasing need for scalable and efficient transportation options is expected to propel the growth of this segment.

Application Outlook

The passenger segment led the hybrid train market in 2024, driven by the growing demand for sustainable, efficient, and comfortable public transportation. Urbanization, daily commuting needs, and increasing road congestion have boosted the popularity of mass transit systems focused on enhancing passenger convenience. Modern rail networks support high-capacity movement while offering reduced travel times and improved onboard experiences.

Meanwhile, the freight segment is expected to grow significantly during the forecast period. This growth is fueled by the rising need for reliable, cost-effective, and energy-efficient logistics solutions. As industries aim to reduce carbon emissions and shift away from road transport, rail-based freight is gaining momentum. Technological advancements in freight systems, smart tracking, and intermodal logistics, along with increasing investments in infrastructure and dedicated freight corridors, are enhancing efficiency and capacity. With global trade expanding and sustainability becoming a business priority, the freight segment is set for rapid growth.

Recent Developments

Stadler Rail – FLIRT Akku Upgrade

- In January 2024, Stadler Rail successfully upgraded its FLIRT Akku hybrid trains with advanced lithium-ion batteries, significantly increasing operational range and reducing charging time. This enhancement supports regional routes without full electrification, cutting reliance on diesel and lowering operational costs. Wider deployment across German networks is planned for 2025.

Hitachi Rail – Masaccio Tri-Mode Launch

- In October 2023, Hitachi Rail introduced its Masaccio tri-mode hybrid trains in the UK, capable of operating on electric, battery, and diesel power. Designed to reduce emissions on partially electrified routes, the trains also feature regenerative braking and onboard energy storage. Initial rollouts are targeting intercity and regional services, aligning with the UK’s climate goals.

Hybrid Train Market Companies

- CRRC Corporation Limited

- Alstom SA

- Siemens AG

- Hitachi Rail STS

- Wabtec Corporation

- Construcciones y Auxiliar de Ferrocarriles

- Hyundai Rotem Company

- Talgo

The Kinki Sharyo Co., Ltd.