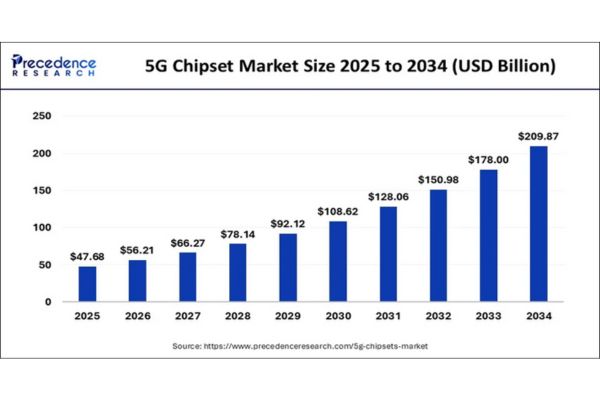

The global 5G chipset market size reached USD 47.68 billion in 2024 and is projected to hit around USD 247.43 billion by 2034, with a remarkable CAGR of 17.90% from 2025 to 2034.

The 5G chipset market is witnessing significant growth, driven by the rapid global deployment of 5G technology and increasing demand for high-speed, low-latency connectivity. These chipsets are integral components in a wide range of devices, including smartphones, routers, connected vehicles, and IoT infrastructure, enabling faster data transmission and enhanced network efficiency. Key industry players such as Qualcomm, MediaTek, Samsung, and Intel are heavily investing in R&D to develop advanced 5G chipsets that support sub-6 GHz and mmWave frequency bands. The surge in data-intensive applications, such as augmented reality (AR), virtual reality (VR), and autonomous driving, is further fueling market expansion. Additionally, government initiatives and investments in smart city projects and digital infrastructure are creating favorable conditions for the adoption of 5G technologies, thereby boosting the chipset market globally.

5g Chipset Market Key Points

- Asia Pacific dominated the global market with the largest market share of 48% in 2024.

- By frequency type, the sub-6GHz sector segment contributed the biggest market share of 65% in 2024

- By processing node type, the 7 nm segment captured the highest market share of 64.8% in 2024.

- By deployment, the smartphones/tablets segment held the major market share of 55.4% in 2024.

Regional Insights

The Asia Pacific 5G chipset market size surpassed USD 22.89 billion in 2024 and is predicted to expand around USD 120 billion by 2034, at a CAGR of 18.02%. Asia Pacific leads the 5G chipset market, largely due to the aggressive rollout of 5G networks in countries like China, South Korea, Japan, and India. China dominates the region with massive investments in 5G infrastructure, a robust semiconductor industry, and support from companies like Huawei and MediaTek. South Korea and Japan are also pioneers in 5G technology, with advanced consumer electronics driving chipset demand. India’s growing telecom sector and push for local manufacturing are expected to further fuel market expansion in the coming years.

North America is the fastest-growing region in the 5G chipset market, primarily driven by rapid technological advancements, early 5G adoption, and the strong presence of major players such as Qualcomm, Intel, and Broadcom. The U.S., in particular, has been at the forefront of 5G infrastructure development, bolstered by government support and significant investments from private telecom giants. This has led to a high demand for advanced chipsets that support 5G connectivity across consumer electronics, automotive, and industrial applications.

Europe holds a significant share in the global 5G chipset market, with countries like Germany, the UK, and France making notable strides in 5G deployment. The European Union’s emphasis on digital transformation and smart city initiatives is accelerating the demand for 5G-compatible devices and infrastructure. Additionally, the presence of key telecom equipment manufacturers such as Ericsson and Nokia enhances regional chipset development and deployment, particularly for enterprise and industrial use cases.

5g Chipset Market Top Companies

- Qualcomm, Inc. (US)

- Intel Corporation (US)

- Samsung Electronics Co., Ltd. (South Korea)

- Qorvo, Inc. (US)

- Huawei Investment & Holding Co., Ltd. (China)

- Xilinx, Inc. (US)

- Analog Devices, Inc. (US)

- NXP Semiconductors N.V. (Netherlands)

- Marvell Technology Group (Bermuda)

- Broadcom Inc. (US)

5G Chipset Market Recent Activities

AI Integration: A prominent trend is the integration of AI capabilities into 5G chipsets, enabling on-device AI processing for applications like real-time analytics and autonomous vehicles.

Qualcomm’s Innovations: Qualcomm introduced the Snapdragon 8 Elite chipset, featuring the new Oryon CPU, an X80 5G modem-RF chip, and enhanced AI functionalities.

MediaTek’s Market Leadership: In Q1 2024, MediaTek surpassed Qualcomm to become the leading 5G smartphone chipset provider, capturing a 29.2% market share.

Type Analysis

The market can be segmented by type, including modems and RFICs (Radio Frequency Integrated Circuits). Modems serve as crucial components in any wireless communication system, as they are responsible for converting digital data into signals and vice versa. With the growth in high-speed mobile broadband networks like 5G, the role of modems becomes even more pivotal, enabling ultra-fast internet connectivity in smartphones, tablets, and other wireless devices. On the other hand, RFICs are integral to wireless hardware, used for processing high-frequency radio signals. These components play a foundational role in enabling the performance of devices across telecom infrastructure and consumer electronics, and their demand is expected to grow significantly in tandem with the global expansion of wireless technologies.

Frequency Type Analysis

When segmenting by frequency type, the spectrum is divided into Sub-6 GHz, 26–39 GHz, and above 39 GHz. The Sub-6 GHz frequency band is the most commonly used spectrum in early-stage 5G deployments. It offers a good balance between coverage and speed, with the ability to penetrate buildings and cover larger geographical areas, making it highly suitable for both urban and rural environments. Meanwhile, the 26–39 GHz band, also known as the millimeter-wave (mmWave) spectrum, provides ultra-high data rates and extremely low latency, although it has limited coverage. This frequency is ideal for high-density areas such as stadiums and smart cities. Frequencies above 39 GHz are part of advanced research for future network developments like 6G and offer the potential for extremely fast data transmission, albeit with challenges like signal attenuation and limited range that need innovative solutions.

Processing Node Type Analysis

From the perspective of processing node type, the market is classified into 7 nm, 10 nm, and above 28 nm categories. The 7 nm process node represents the leading edge of semiconductor manufacturing and is predominantly used in high-performance devices such as flagship smartphones, advanced computing systems, and high-speed communication modules. It offers advantages like reduced power consumption and faster performance. The 10 nm node, though slightly older, is still used in many devices that balance cost and performance effectively. Chips produced above 28 nm are generally found in simpler, cost-effective electronics, including various IoT devices and traditional network hardware, where cutting-edge miniaturization is not as critical.

Deployment Type Analysis

Based on deployment type, wireless communication technologies are applied across multiple domains such as telecom base station equipment, smartphones/tablets, connected vehicles, connected devices, broadband access gateway devices, and others. Telecom base stations are the backbone of mobile networks, supporting infrastructure for transmitting data across wide networks. Smartphones and tablets remain the most visible consumer products driving demand for advanced communication chips, as users increasingly require fast and reliable connectivity. Connected vehicles represent a growing frontier, where communication technologies support vehicle-to-everything (V2X) capabilities for autonomous driving and smart traffic systems. Similarly, the proliferation of connected devices, especially in smart homes and industrial IoT, necessitates reliable, low-power wireless solutions. Broadband access gateway devices such as routers and modems are essential in both consumer and business settings, enabling internet access via fiber and wireless connections. The “others” category includes applications like drones, augmented reality (AR)/virtual reality (VR) systems, and smart city infrastructure that rely on consistent wireless performance.

End Use Analysis

Finally, by end use, the market spans diverse industries including manufacturing, energy & utilities, media & entertainment, IT & telecom, transportation & logistics, healthcare, and other sectors. In manufacturing, wireless technologies are essential for implementing smart factory systems, automation, and real-time monitoring as part of the Industry 4.0 revolution. The energy and utilities sector leverages connectivity for remote monitoring of infrastructure like power grids and pipelines, ensuring efficiency and safety. In media and entertainment, the demand for high-resolution content streaming and immersive experiences such as VR and AR is driving the adoption of low-latency, high-bandwidth wireless networks. IT and telecom companies are not only leading the innovation in this field but are also among the biggest consumers of these technologies. Transportation and logistics benefit from enhanced tracking systems, fleet management, and intelligent transportation solutions. Healthcare is rapidly integrating wireless systems for remote diagnostics, telemedicine, and connected medical devices, enhancing patient care and operational efficiency. Other end-use areas, including education, retail, agriculture, and government, are also increasingly adopting wireless technology to modernize services and improve productivity.