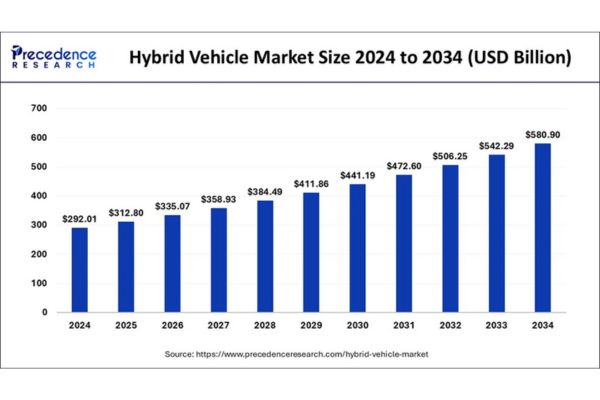

The global hybrid vehicle market size was valued at USD 292.01 billion in 2024 and is expected to reach USD 580.90 billion by 2034 with a CAGR of 7.12%.

Hybrid Vehicle Market Key Insights

- In 2024, North America led the global hybrid vehicle market, accounting for the largest share of 52%.

- The Asia Pacific region is projected to witness strong growth at a robust CAGR over the forecast period.

- Among hybridization types, the fully hybrid segment held the dominant position with a 50% market share in 2024.

How Is AI Transforming the Hybrid Vehicle Market?

Artificial Intelligence is playing a pivotal role in enhancing the performance, efficiency, and user experience of hybrid vehicles. AI algorithms are being integrated into powertrain systems to optimize energy distribution between the internal combustion engine and electric motor, leading to better fuel efficiency and reduced emissions. Additionally, AI-powered predictive analytics help in monitoring driving patterns, terrain conditions, and traffic data to intelligently adjust power usage in real time.

What Other Advancements Does AI Bring to Hybrid Vehicles?

Beyond performance optimization, AI is revolutionizing hybrid vehicles through advanced driver-assistance systems (ADAS), autonomous driving features, and smart infotainment. Voice-activated controls, adaptive cruise control, and lane-keeping assistance are now more accurate and responsive due to machine learning and AI integration. Moreover, AI helps in predictive maintenance by identifying potential mechanical issues before they become serious, improving vehicle safety and longevity.

Regional Outlook of the Hybrid Vehicle Market

Asia Pacific

Asia Pacific is the fastest-growing market for hybrid vehicles, with its market size estimated at USD 151.85 billion in 2024 and projected to reach around USD 304.97 billion by 2034. Countries like Japan, China, and South Korea are leading this growth, driven by mass adoption and strong sales from major automakers such as Toyota, Honda, Nissan, and Hyundai. In China, hybrids are now more popular than battery-only vehicles, with BYD selling over 2.5 million hybrids in 2024. The region benefits from government support, increasing consumer demand, and a robust manufacturing base.

North America

North America is experiencing significant growth in hybrid vehicle adoption, supported by strict pollution laws, consumer awareness, and government incentives. The U.S. leads the region, with hybrid car sales reaching a record 1.2 million units in 2023—a 17% increase from the previous year. Federal tax credits, state-level incentives, and investments in charging infrastructure are accelerating market penetration. Major players like Toyota, Ford, and Honda dominate the U.S. hybrid market, and ongoing infrastructure improvements are expected to sustain growth.

Europe

Europe’s hybrid vehicle market is expanding rapidly, fueled by EU carbon emission targets, rising fuel prices, and increased environmental awareness. Germany stands out as a leader, with strong government incentives and a proactive automotive industry. Major German manufacturers such as BMW, Audi, and Mercedes-Benz are launching new hybrid models to meet EU standards. Policy changes, purchase subsidies, and the development of low-emission zones are further driving adoption across the continent

Hybrid Vehicle Market Scope – Key Highlights

Market Size in 2025: USD 312.80 Billion

Market Size by 2034: USD 580.90 Billion

CAGR (2025 to 2034): 7.12%

Forecast Period: 2025 to 2034

Market Drivers

The hybrid vehicle market is primarily driven by increasing environmental awareness and stringent emission regulations globally. Governments are offering subsidies, tax incentives, and regulatory support to promote cleaner mobility solutions, pushing both manufacturers and consumers toward hybrid technologies. Additionally, rising fuel prices and advancements in battery technology are encouraging the adoption of fuel-efficient hybrid vehicles.

Market Opportunities

Significant opportunities lie in the rapid technological innovations in hybrid powertrains and energy management systems. The growing demand for low-emission vehicles in emerging economies, particularly in Asia Pacific, presents a vast growth potential. Expansion of charging infrastructure and the integration of AI and IoT features into hybrid models also open new avenues for market expansion and consumer engagement.

Market Challenges

Despite growth potential, the hybrid vehicle market faces challenges such as high production costs and limited availability of charging and maintenance infrastructure in some regions. Consumer hesitation due to the relatively higher price of hybrid models compared to conventional vehicles and the complexity of dual powertrains can also hinder widespread adoption.

Role of Leading Companies in the Hybrid Vehicle Market

Toyota Motor Company

- Pioneer and Market Leader: Toyota is widely recognized as the most influential hybrid car maker, having launched the world’s first mass-market hybrid, the Prius, in 1997. The company has sold over 27 million electrified vehicles globally, significantly reducing CO₂ emissions.

- Strategic Focus: Toyota is expanding its hybrid lineup, aiming for hybrids to comprise over 50% of its total sales volume soon. Its multi-pathway strategy includes hybrids, plug-in hybrids, battery electric, and hydrogen vehicles.

- Global Impact: Toyota dominates hybrid sales in key markets like the U.S. and India, where it commands an 80% share of the strong hybrid segment.

- Hybrid vehicles accounted for 48.9% of Toyota’s global sales in 2024, with 3.6 million hybrid units sold. Toyota achieved a record profit of ¥5.3 trillion ($34bn), largely driven by hybrid sales

Honda Motor Company

- Aggressive Growth Plans: Honda aims to double its annual hybrid sales to 1.3 million units by 2030, focusing on North America and other major markets.

- Technology Development: The company is rolling out new hybrid platforms and more efficient powertrains to meet tightening emission regulations in the U.S., Europe, Japan, and China.

- Carbon Neutrality Goal: Honda’s hybrid strategy is a key part of its plan to achieve carbon neutrality by 2050.

- Honda aimed to double its global hybrid sales to 1.3 million units by 2030. In 2024, the company saw strong hybrid demand, especially in North America, but specific hybrid revenue share for 2024 is not disclosed.

BYD Company Ltd

- Rapid Expansion: BYD has become a major player in the hybrid market, with hybrid sales outpacing its pure EVs in China. The company’s profitability has increased as a result, with operating margins rising from 3% to 5% in recent years.

- Cost Advantage: BYD leverages mature hybrid technology to maintain production cost advantages, making hybrids a core part of its global growth strategy.

- BYD’s 2024 revenue surged to 777 billion yuan (~$107 billion), surpassing Tesla, with hybrid sales leading growth. Hybrids were a major driver of BYD’s global revenue increase.

Lexus

- Premium Hybrid Leadership: As Toyota’s luxury division, Lexus has sold over one million hybrid vehicles worldwide since 2005, leading the premium hybrid segment.

- Strategic Focus: Lexus is prioritizing hybrid models for sustainable growth, especially in markets like India, until its first battery-electric vehicles launch in 2026. The brand plans to become fully electric by 2035, but hybrids remain central to its current strategy.

- Lexus (Toyota’s luxury division) achieved a record 52% of global sales from electrified vehicles (mainly hybrids) in 2024, with 851,214 units sold worldwide

Ford Motor Company

- Bridging Technology: Ford is aggressively expanding its hybrid lineup as a bridge for consumers transitioning from gasoline to electric vehicles. Hybrids are a key part of Ford’s electrification strategy, helping the company achieve double-digit sales growth in electrified vehicles.

- Market Position: Ford’s hybrid surge is positioning it as a leader in the American electrified vehicle market, catering to a broad range of consumer preferences.

- Ford sold 187,426 hybrid vehicles in 2024, a 40% increase over 2023. Hybrids were a key contributor to Ford’s 6% retail sales growth and record EV/hybrid performance

Kia Motors Company

- Strategic Shift: Kia is introducing hybrid versions of popular models like the Seltos to capitalize on rising hybrid demand, especially in markets like India and Europe.

- Electrification Roadmap: The company aims to offer electrified options across its SUV and RV lineup, with hybrid penetration expected to grow as emission regulations tighten.

- Kia reported a record operating profit of 12.67 trillion won ($8.86 billion) in 2024, driven by strong hybrid and SUV sales. Hybrid models were a major factor in revenue growth.

Nissan Motor Company

- Innovative Technology: Nissan is focusing on its proprietary e-Power hybrid technology, which uses a gasoline engine to charge the battery, providing an EV-like driving experience without the need for external charging.

- Global Rollout: The company is launching new hybrid and electric models in key regions, including Europe, North America, and Japan, and is closely monitoring hybrid opportunities in emerging markets like India.

- Turnaround Strategy: Nissan’s hybrid push is central to its efforts to regain market share and profitability.

- Nissan’s total revenue was 12.6 trillion yen in 2024, but the specific share from hybrids is not disclosed. The company is expanding its hybrid lineup as part of its turnaround strategy.

Volkswagen AG

- Significant Volume: Volkswagen Group delivered nearly 270,000 plug-in hybrid vehicles globally in 2024, marking a 5% increase over the previous year.

- Product Range: The company offers plug-in hybrid options across several popular models, including the Passat, Golf, Tiguan, and Arteon, supporting its broader electrification goals.

- Volkswagen delivered 269,600 plug-in hybrid vehicles globally in 2024, a 5% increase over 2023. The hybrid segment is a growing part of VW’s electrified vehicle revenue.

AB Volvo

- Flexible Electrification: Volvo revised its 2030 target to a mix of 90-100% plug-in hybrids and battery electric vehicles, responding to changing market conditions and consumer demand.

- Sustainability Commitment: The company remains committed to an electric future but recognizes the ongoing importance of hybrids as part of a non-linear transition to full electrification.

- Volvo’s plug-in hybrid sales rose 16% to 177,593 units in 2024, accounting for 23% of total sales. Hybrids remain a significant revenue contributor alongside full electrics.

Segments Covered in the Report

By Hybridization

- Fully hybrid

- Micro hybrid

- Mild hybrid

By Drivetrain

- Parallel drivetrain

- Series drivetrain

By Vehicle

- Passenger car

- Commercial vehicles

By Propulsion

- HEV

- PHEV

- NGV

By Component Type

- Battery

- Electric Motor

- Transmission

Source: https://www.precedenceresearch.com/hybrid-vehicle-market