Challenging EV market

Global sales of battery electric vehicles (BEV) and cars had grown rapidly from 2015-2023. For example, in the US, BEV car sales increased from 240,000 in 2020 to almost 1.2 million in 2023, driven by strong policy support with a similar picture in the other key regions of China and Europe. But the industry has encountered a more challenging environment in 2024. While sales remain relatively strong in China, there has been a slowdown in the growth of EV sales in Europe and North America. There are numerous reasons for this, including a lack of models and a difficult economic environment, but better and cheaper batteries and higher-performing EVs remain critical to convincing consumers to purchase them. Longer ranges, faster charging times and stable performance in colder weather could be important to accelerating the outlook for BEVs, and Li-ion batteries using silicon-based anodes offer one route to achieving this.

IDTechEx’s report on the topic, “Silicon Anode Battery Technologies and Markets 2025-2035: Players, Technologies, Applications, Markets, Forecasts”, provides analysis and discussion of silicon anode technologies, the silicon anode market, key players, and start-ups, provides a production outlook, and forecasts by region and application by GWh, kt and US$.

Higher performance from silicon

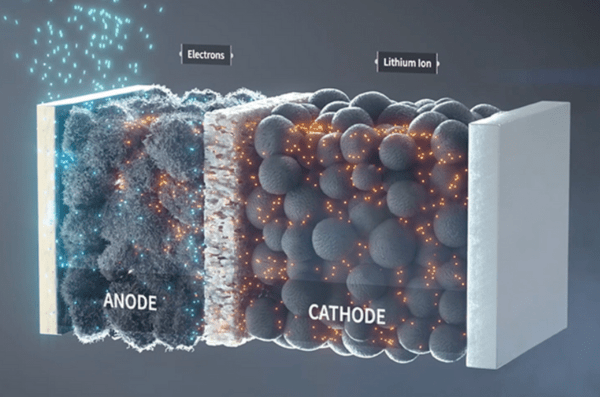

The current iteration of Li-ion batteries are starting to reach their performance limits. Shifts in electrode materials and cell designs are necessary to move beyond energy densities of around 600-700 Wh/l, which are exhibited by state-of-the-art cells based on graphite anodes and high-nickel NMC/NCA cathodes. With the nickel percentage in NMC/NCA cathodes already starting to reach 90%, capacity and energy density gains from the cathode will be limited. Similarly, cell designs are relatively well optimized, and while further improvements are possible, large shifts in performance from innovations to cell design are unlikely. At the cell level, this leaves the choice of anode material as a key lever for improving battery performance, with silicon emerging as a leading alternative to the graphite currently used in most Li-ion batteries.

Silicon has a theoretical capacity of 3590 mAh/g compared to 372 mAh/g for graphite. This high capacity allows anodes utilizing silicon to be thinner and less dense, leading to higher energy densities and helping to improve fast charge capability. Moving toward anode compositions with even modest quantities of silicon can improve energy density significantly, while high-silicon or silicon-dominant anodes could enable energy density improvements of 30-50%, with values in excess of 1000 Wh/l being reported.

Rate capability and fast-charge capability can also be enhanced through the use of silicon, a characteristic that is becoming increasingly important for battery manufacturers and auto OEMs. Many silicon anode developers are highlighting improvements in this area. To name a few, Daejoo Electronic Materials are targeting commercialization of material that will enable charging times of 15-18 minutes in 2025/26. Group14 Technologies have supplied material to Molicel for 265 Wh/kg, 714 Wh/l cells that can be repeatedly cycled at a 5C charge rate (12-minute charge). Storedot have focussed on rate capability, developing batteries that can allow the addition of 100 miles of EV range after a 5-minute charge, while numerous other developers report on the battery charging speed improvements possible from their silicon anode technologies.

Multiple routes to silicon adoption

Despite the promising benefits of using silicon, its large volumetric expansion, by up to 300%, causes numerous issues, from electrolyte and lithium consumption to loss of electrical and ionic conductivity, ultimately leading to low cycle life. Therefore, where silicon material has been used, it’s been as an additive to graphite at low weight percentages. Numerous technologies and solutions have been under development to enable the use of silicon beyond 10% of the anode and toward compositions where silicon makes up the majority, if not 100%, of the active material of the anode. Materials and technologies being developed include silicon-carbon composites, silicon-graphite composites, silicon oxides, pure silicon materials, and silicon nanostructures. This is alongside the use of various coating materials, electrolyte additives, and other techniques designed to improve cycle life and lifetime.

The different solutions being developed can offer distinct advantages and disadvantages. For example, silicon-carbon composites have attracted significant interest, with materials typically incorporating silicon into porous carbon structures via a chemical vapor deposition (CVD) process. The porous carbon structure provides space for the volume expansion of silicon whilst providing electrical conductivity but controlling the deposition process can be difficult, and production can be expensive. Similarly, the direct deposition of silicon structures onto a conductive foil, whilst offering the potential for the most significant performance benefits, is also likely to remain expensive and would require a greater shift in the cell production process.

Cost could remain a barrier

As highlighted, cost may remain a barrier to the widescale adoption of more advanced silicon anode solutions. Silicon anode material is priced at a premium compared to graphite on a US$/kg and US$/kWh basis. The highly engineered nature of silicon anode materials, the use of silane gas in some cases, and the relatively early stage of the silicon anode market are likely to limit the cost reduction potential in the short term. Nevertheless, the higher capacity of silicon allows for less material to be used, while the wide availability of silicon and growing production capacity and competition offer hope for cost-competitive solutions in the future. In the short term, the deployment of the next generation of silicon anode materials for higher silicon percentage anodes is likely to come first for premium EV segments, as well as other applications with lower price sensitivity, such as smartphones or drones.

Silicon anodes could play an important role in accelerating the deployment of EVs by providing potentially significant improvements to Li-ion battery energy density and charging times. To find out more on the range of silicon anode technologies being developed, commercialized, and produced, including for Si-C and Si-Gr composites, silicon oxides, and pure silicon materials, see the IDTechEx report “Silicon Anode Battery Technologies and Markets 2025-2035: Players, Technologies, Applications, Markets, Forecasts”.