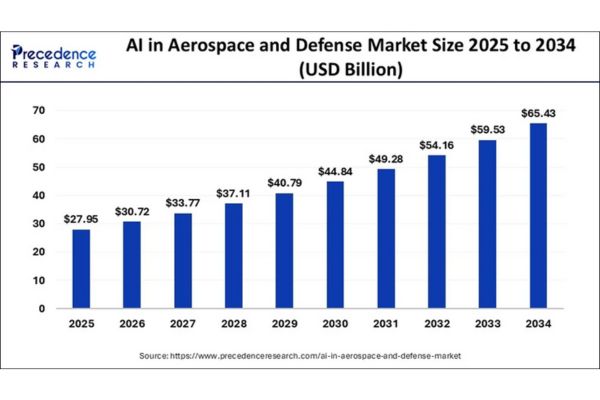

According to Precedence Research, the AI in aerospace and defense market size was estimated at USD 25.43 billion in 2024 and is projected to attain around USD 65.43 billion by 2034, with a CAGR of 9.91%.

AI in Aerospace and Defense Market Key Points

- In 2024, the global AI in aerospace and defense market was valued at USD 25.43 billion, and it is projected to reach approximately USD 65.43 billion by 2034, growing at a CAGR of 9.91% between 2025 and 2034.

- North America led the market in 2024, capturing the largest share at 41%.

- Europe is expected to experience the fastest growth rate during the forecast period.

- Based on offering, the hardware segment dominated the market in 2024, while the software segment is projected to witness robust growth in the coming years.

- In terms of deployment, the on-premises segment held the largest share in 2024, whereas the cloud-based segment is anticipated to expand significantly during the forecast period.

- Among platforms, the airborne segment led the market in 2024, and the space segment is expected to register the highest CAGR going forward.

- By technology, machine learning held the largest market share in 2024, while computer vision is set to grow at a notable CAGR.

- The surveillance & monitoring segment accounted for the highest share in 2024 by application, whereas the navigation & guidance systems segment is forecasted to grow the fastest.

- In terms of end-use, the government & law enforcement segment held the dominant share at 52% in 2024, while the commercial segment is expected to expand at a strong pace throughout the forecast period.

What Are the Current Trends in the AI in Aerospace and Defense Market?

The AI in aerospace and defense market is witnessing rapid growth driven by advancements in autonomous systems, such as AI-controlled aircraft and “loyal wingman” drones. Venture capital funding is soaring, with governments investing in sovereign AI capabilities to strengthen national security. Startups are disrupting traditional defense procurement by offering agile, software-driven solutions.

Generative AI is being used in aircraft design and cybersecurity, while predictive maintenance and edge AI improve operational efficiency and real-time decision-making. There’s a strong rise in AI-powered unmanned systems (UAVs, UGVs, USVs), boosting surveillance and combat capabilities.

AI is also enhancing tactical communications, electronic warfare, and defense infrastructure, with nations updating regulations and integrating AI into air defense systems. These trends mark AI as a critical force in shaping the future of global aerospace and defense operations.

What Role Does AI Play in the Aerospace and Defense Industry?

AI plays a transformative and strategic role in the aerospace and defense industry by enhancing operational efficiency, decision-making, autonomy, and threat response capabilities. Its integration is redefining how military forces and aerospace companies design, build, and manage systems.

- Autonomous Systems & Combat Operations

AI powers unmanned aerial, ground, and sea vehicles (UAVs, UGVs, USVs), enabling autonomous navigation, mission execution, and swarming tactics. It is at the heart of “loyal wingman” programs, where drones support manned aircraft in combat using AI-driven coordination and decision-making. - Surveillance, Reconnaissance, and Targeting

AI algorithms process massive volumes of data from satellites, drones, and sensors to detect threats, recognize patterns, and provide real-time intelligence. This improves situational awareness and allows for faster, more accurate targeting and monitoring. - Predictive Maintenance & Logistics Optimization

AI helps predict equipment failures before they happen by analyzing sensor data from aircraft and military hardware. This reduces downtime, enhances fleet readiness, and lowers operational costs by enabling condition-based maintenance. - Cybersecurity and Electronic Warfare

In cyber and electronic domains, AI supports threat detection, intrusion prevention, and spectrum management. It automates defense responses, simulates attacks, and helps protect critical defense networks and communications from adversaries. - Design and Manufacturing (Generative AI)

Aerospace companies use AI-driven design tools to optimize aircraft components for weight, strength, and fuel efficiency. AI also aids in supply chain optimization and automated manufacturing, accelerating production cycles and reducing costs. - Training and Simulation

AI enables realistic combat simulations and virtual training environments for pilots and soldiers. These AI-based systems adapt to individual performance and provide data-driven feedback, improving preparedness and skill development. - Decision Support and Command Systems

AI enhances command and control by integrating battlefield data from multiple sources, analyzing scenarios, and recommending strategic or tactical actions in real time. This ensures faster, data-driven military decisions in dynamic situations. - Space Operations and Satellite Management

In the aerospace segment, AI is used to monitor satellite health, optimize orbital routes, and detect anomalies in space assets. It also supports space situational awareness, helping avoid collisions and manage increasing satellite traffic.

What is the Regional Outlook of AI in the Aerospace and Defense Market?

North America

North America led the global AI in aerospace and defense market in 2024, primarily driven by significant investments in both commercial aviation and defense. The United States is at the forefront, with major companies like Boeing, Lockheed Martin, and Northrop Grumman heavily investing in AI to enhance aircraft design, autonomous systems, and military applications. The U.S. government and military are also prioritizing AI integration in defense contracts, ensuring continued regional dominance.

Europe

Europe is projected to experience the fastest growth in the coming years. This growth is fueled by the region’s leadership in civil and military aircraft, helicopters, drones, aero engines, and related systems. Major aerospace enterprises are based in countries such as France, Germany, Italy, and Spain. The region’s robust manufacturing base and ongoing investments in AI-driven innovation are expected to accelerate adoption across the aerospace and defense sectors.

Asia Pacific

Asia Pacific is set for substantial growth, driven by rising security concerns and increased investments in AI technologies. Governments in the region are introducing initiatives to support AI adoption, and companies are collaborating to develop new applications. These efforts are enhancing surveillance, security, and operational efficiency, positioning Asia Pacific as a rapidly expanding market for AI in aerospace and defense

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 65.43 Billion |

| Market Size in 2024 | USD 25.43 Billion |

| Market Size in 2025 | USD 27.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment Type, Platform, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

AI In Aerospace and Defense Market Companies

- The Boeing Company:

Integrates AI for predictive maintenance, aircraft design, and autonomous systems; collaborates with Microsoft on AI cloud training for defense.

2023 Revenue: $77.8 billion - Lockheed Martin:

Major investor in AI for automated mission planning, synthetic-aperture radar, and manned–unmanned teaming; frequent recipient of U.S. defense AI contracts.

2023 Revenue: $67.6 billion - Northrop Grumman Corporation:

Leads in AI-enabled autonomous systems, surveillance, and military applications; significant contracts for battle-management AI.

2023 Revenue: $35.2 billion - RTX Corporation (Raytheon Technologies):

Develops AI for smart weapon solutions, navigation guidance, and advanced defense systems; strong presence in AI-enhanced avionics.

2023 Revenue (Raytheon segment): $39.6 billion - Thales Group:

Focuses on AI for surveillance, avionics, and secure communications in aerospace and defense, especially in Europe.

2023 Revenue: $19.9 billion - Honeywell International Inc.:

Expands AI in avionics and space portfolios, notably after acquiring CAES; provides AI-driven predictive maintenance and quality control.

2023 Revenue: $36.7 billion - Deutsche Telekom AG:

Supports AI-driven secure communications and data infrastructure for defense applications, particularly in Europe. - General Electric Co.:

Applies AI for predictive maintenance, engine diagnostics, and operational efficiency in aerospace. - Indra Sistemas SA:

Implements AI for defense systems, surveillance, and air traffic management, with a focus on European markets.

2023 Revenue: $4.5 billion - Intel Corporation:

Supplies AI chips and processors for defense analytics, edge computing, and autonomous platforms. - International Business Machines Corporation (IBM):

Develops AI software for data fusion, decision support, and cybersecurity in aerospace and defense. - Iris Automation:

Specializes in AI-based collision avoidance and autonomous flight systems for drones and unmanned aerial vehicles. - Microsoft Corporation:

Provides AI cloud infrastructure (e.g., Azure Government) for secure training and simulation in defense applications. - NVIDIA Corporation:

Supplies AI hardware (GPUs) and software frameworks for simulation, autonomy, and data analytics in aerospace and defense. - Raytheon Technologies Corporation:

See RTX Corporation above; focus on AI for smart weapons, avionics, and defense systems.

2023 Revenue (Raytheon segment): $39.6 billion - SparkCognition Inc.:

Provides AI-powered solutions for predictive maintenance, cybersecurity, and operational intelligence in aerospace and defense. - Safran:

Uses AI for engine diagnostics, predictive maintenance, and avionics in aerospace, especially in Europe.

2023 Revenue: $23.2 billion

Segmental Insights of the AI in Aerospace and Defense Market

Offering Insights

The hardware segment held the largest share in 2024, driven by the need for efficient processing of large datasets. Key hardware includes processors, AI accelerators, and specialized memory units, all crucial for high-performance AI tasks in aerospace and defense. The software segment is expected to grow rapidly, fueled by increasing integration of AI software in aircraft and space vehicles, and the necessity to meet strict aviation regulatory standards.

Deployment Type Insights

On-premise deployment dominated in 2024, as organizations in aerospace and defense prioritize control, security, and privacy by running AI applications within their own infrastructure. However, cloud-based deployment is anticipated to see significant growth, offering scalability and access to advanced AI capabilities like machine learning and computer vision for organizations seeking flexibility and competitive advantage.

Platform Insights

The airborne segment led the market, supported by the use of AI in intelligence, surveillance, and reconnaissance for faster threat identification and enhanced payload management in drones and aircraft. The space segment is projected to grow at the highest CAGR, with AI driving advancements in autonomous space exploration, in-space servicing, and resilient communication systems.

Technology Insights

Machine learning was the largest technology segment in 2024, widely used for aircraft design, optimization, structural health monitoring, and navigation. Computer vision is expected to grow notably, as it enables rapid analysis of visual data for improved military operations, safety, and decision-making.

Application Insights

Surveillance and monitoring accounted for the highest market share, reflecting the critical need for real-time threat detection and information relay to air traffic control and defense systems. Navigation and guidance systems are expected to expand quickly, as AI-driven solutions provide advanced precision for smart weapons and munitions.

End-use Insights

The government and law enforcement segment held the largest share, leveraging AI for public safety, criminal justice, and security operations. The commercial segment is set for robust growth, with generative AI streamlining aircraft manufacturing and enabling personalized air travel experiences.