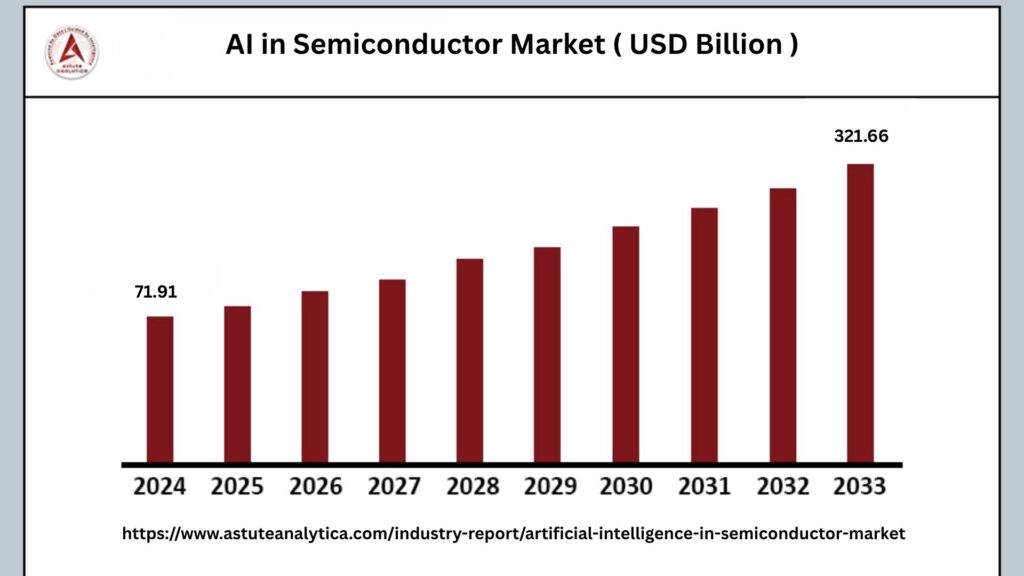

The global artificial intelligence in the semiconductor market was valued at US$ 71.91 billion in 2024 and is projected to reach US$ 321.66 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 18.11% during the forecast period from 2025 to 2033.

Artificial intelligence (AI) is fundamentally transforming the semiconductor industry by reshaping how chips are designed, manufactured, and optimized for performance. Traditionally, semiconductor development followed established engineering principles, but AI technologies are now being integrated throughout the entire chip lifecycle.

The semiconductor market for AI applications is experiencing rapid and sustained growth, driven by the surging demand for AI-powered solutions across a wide range of industries. Enterprises in sectors such as healthcare, automotive, finance, and consumer electronics are increasingly relying on AI technologies to enhance automation, improve decision-making, and deliver smarter products and services.

Artificial Intelligence (AI) in Semiconductor Market Key Takeaways

- Graphics Processing Units (GPUs) have solidified their position as the dominant chip type in the artificial intelligence (AI) semiconductor market, capturing more than 38% of the market share as of 2024.

- Data centers and cloud computing infrastructure represent the largest application segment within the AI semiconductor market, commanding over 35% of the market share.

- IT infrastructure and data centers have emerged as the leading end users of AI semiconductors, collectively accounting for more than 40% of the market share.

- Within the technological landscape, machine learning stands out with a commanding 39% share of the global AI semiconductor market.

Regional Analysis

North America’s Commanding Market Position in AI Semiconductors

North America continues to maintain a commanding lead in the artificial intelligence (AI) semiconductor market, holding over 40% of the global market share. This dominant position arises from a powerful combination of strategic government initiatives, substantial venture capital investments, and a highly advanced technological infrastructure.

- Hyperscale Data Centers Driving Demand: A critical pillar of North America’s leadership is its concentration of hyperscale data centers, which serve as the backbone for AI computing and cloud services. Industry giants such as Amazon, Google, and Microsoft operate massive data center networks that generate relentless demand for state-of-the-art AI semiconductors.

- World-Class Research Institutions Fueling Innovation: North America’s advanced research institutions also play a vital role in sustaining its competitive advantage. Prestigious universities such as MIT and Stanford are at the forefront of AI and semiconductor research, consistently producing top-tier talent and pioneering breakthrough technologies. These institutions foster close collaborations with industry leaders, enabling rapid technology transfer and commercialization.

- The United States as the Epicenter of North American Dominance: Within North America, the United States stands out as the epicenter of AI semiconductor market dominance. It boasts an unparalleled concentration of leading semiconductor companies, startups, and research hubs dedicated to AI hardware advancements. Complementing this industrial strength are national policies that strategically support AI development through funding programs, infrastructure investment, and regulatory frameworks tailored to nurture innovation.

Asia Pacific: The Second-Largest and Fastest-Growing AI Semiconductor Market

The Asia Pacific region has emerged as the second-largest and fastest-growing market in the artificial intelligence (AI) semiconductor sector. This rapid growth is fueled by the region’s strong manufacturing capabilities combined with a swiftly expanding adoption of AI technologies across a wide array of industries.

- Driving Growth Through IoT and Diverse Industry Adoption: A significant driver behind Asia Pacific’s AI semiconductor market expansion is the rising demand for Internet of Things (IoT) devices. These devices, spanning consumer electronics, automotive systems, and industrial applications, require sophisticated AI chips to enable smart functionalities such as real-time data processing, automation, and predictive maintenance.

- China’s Aggressive Investment Strategy: China plays a pivotal role within the Asia Pacific region by aggressively investing in AI semiconductor development and manufacturing. The country’s strategic initiatives include substantial funding for domestic semiconductor firms, efforts to reduce reliance on foreign technology, and promotion of indigenous innovation in AI hardware.

- Government Support and Infrastructure Development: Governments across Asia Pacific are prioritizing AI infrastructure development as a foundation for sustained market growth. Many countries have launched initiatives to establish research institutes, innovation corridors, and collaborative platforms that bridge academia and industry. These efforts foster an environment conducive to cutting-edge AI research, technology transfer, and commercialization.

Top Trends Escalating Artificial Intelligence (AI) in Semiconductor Market

AI-Driven EDA Tools Automating Chip Design and Optimization: Artificial intelligence-driven Electronic Design Automation (EDA) tools are revolutionizing the semiconductor industry by automating critical aspects of chip design, verification, and layout optimization. These AI-powered tools leverage machine learning algorithms to analyze complex design data, identify potential flaws, and suggest improvements far more efficiently than traditional methods. By automating verification processes, they reduce the time and cost involved in bringing chips to market while improving overall design accuracy.

Custom AI Accelerators Outperforming General-Purpose Processors: Custom AI accelerators have emerged as specialized semiconductor solutions that significantly outperform general-purpose processors for specific AI tasks. Unlike CPUs or even standard GPUs, these accelerators are designed from the ground up to handle particular AI workloads such as deep learning inference or neural network training. By optimizing architecture, memory access, and data flow for these tasks, custom AI chips achieve greater efficiency, lower latency, and reduced power consumption.

Advanced Packaging Technologies Enhancing AI Performance: Advanced semiconductor packaging technologies like Chip-on-Wafer-on-Substrate (CoWoS) are playing a crucial role in boosting AI chip performance. CoWoS enables the integration of multiple chip components, including processors and high-bandwidth memory, within a single package. This proximity reduces signal latency and increases bandwidth, which is vital for the data-intensive operations characteristic of AI workloads.

Specialized Chips for Generative AI Workloads: The rise of generative AI workloads, such as those powering large language models and creative content generation, has created a demand for specialized chips like GPUs, Tensor Processing Units (TPUs), and Neural Processing Units (NPUs). These chips are optimized to handle the massive matrix multiplications and data throughput required by generative AI models. Their architectures prioritize parallel processing, memory bandwidth, and efficient handling of floating-point operations.

Data Center Expansion Driving AI Accelerator Demand: The rapid expansion of data centers worldwide is fueling an unprecedented demand for AI accelerator chips. Data centers form the backbone of cloud computing and AI services, requiring vast computational resources to train, deploy, and run AI models at scale. This expansion is driven by increasing adoption of AI across industries, higher data volumes, and the need for low-latency AI inference.

Proliferation of Edge AI Across IoT, Automotive, and Surveillance: Edge AI applications are proliferating rapidly across various sectors such as the Internet of Things (IoT), automotive systems, and surveillance devices. Unlike centralized cloud processing, edge AI enables data to be processed locally on devices, reducing latency, improving privacy, and enabling real-time decision-making. This trend has led to increased deployment of AI-optimized chips in a wide range of edge devices, from smart sensors and cameras to autonomous vehicles.

Artificial Intelligence (AI) in Semiconductor Market Segmentation

By Chip Type

Graphics Processing Units (GPUs) have firmly established themselves as the dominant force in the artificial intelligence (AI) semiconductor market, commanding more than 38% of the market share as of 2024. This commanding position reflects the critical role GPUs play in accelerating AI workloads and their unmatched ability to handle the complex computations required by modern AI models.

The core reason behind the dominance of GPUs lies in their unique parallel processing architecture. Unlike traditional central processing units (CPUs), which typically have a limited number of cores optimized for sequential tasks, GPUs boast thousands of smaller cores designed to perform many calculations simultaneously. This massive parallelism is particularly well-suited for the matrix and vector operations common in AI algorithms.

By Application

Data centers and cloud computing infrastructure hold a commanding position in the artificial intelligence (AI) semiconductor market, accounting for over 35% of the total market share. This significant dominance highlights their role as the primary arena for deploying AI semiconductor technologies. The growing reliance on these centralized systems underscores a major transformation in how computing resources are utilized to support AI workloads.

This shift is driven by the increasing complexity and scale of AI applications, which demand vast amounts of computational power that edge devices alone cannot provide. As a result, AI processing has increasingly migrated from decentralized edge hardware to powerful, centralized cloud infrastructures. These data centers are equipped with advanced semiconductor solutions designed specifically to handle the intensive requirements of model training, inference, and data processing on a massive scale.

By End Users

IT infrastructure and data centers have become the largest end users in the artificial intelligence (AI) semiconductor market, commanding an impressive market share exceeding 40%. This dominance is driven by their enormous and ever-growing demand for AI-optimized semiconductors, which are essential to meet the escalating computational needs associated with AI workloads. As data generation continues to grow exponentially, these facilities require increasingly powerful and efficient chips to handle the complex processes of AI model training and inference.

The rapid expansion of AI applications has placed significant pressure on IT infrastructure, necessitating vast computational resources capable of processing and analyzing massive datasets in real time. Data centers, which serve as the backbone of cloud computing and digital services, have responded by investing heavily in specialized semiconductor technologies designed to accelerate AI tasks.

By Technology

Machine learning technology holds a commanding 39% share of the global artificial intelligence (AI) semiconductor market, underscoring its role as the fundamental engine driving AI innovation. This significant market dominance highlights how integral machine learning has become within the semiconductor sector, influencing how AI capabilities are developed and deployed across the industry.

The widespread adoption of machine learning stems from its remarkable versatility. It powers a broad spectrum of applications, including natural language processing, which enables machines to understand and generate human language; computer vision, which allows systems to interpret and analyze visual data; predictive analytics, used for forecasting trends and behaviors; and autonomous systems, which rely on real-time decision-making.

Recent Developments in Artificial Intelligence (AI) in Semiconductor Market

- Nvidia and AMD Resume AI Chip Sales to China: In July 2025, Nvidia Corp. and Advanced Micro Devices Inc. are set to resume sales of certain AI chips in China. This development follows Washington’s assurances that shipments of these chips will receive approval, marking a significant shift from the previous Trump administration’s stricter policies aimed at curbing Beijing’s AI capabilities.

- Nvidia’s New AI Chipset for China: Nvidia plans to launch a new artificial intelligence chipset for the Chinese market in May 2025 at a substantially lower price point than its recently restricted H20 model. Mass production is expected to begin as early as June. This new chipset will be based on Nvidia’s RTX Pro 6000D, a server-class graphics processor, but will utilize conventional GDDR7 memory instead of the more advanced high bandwidth memory (HBM).

- Intel and AWS Expand U.S. Chip Manufacturing: In September 2024, Intel Corporation and Amazon Web Services (AWS) announced an expansion of their strategic collaboration to boost U.S.-based chip manufacturing. As part of the agreement, Intel will produce a custom AI fabric chip for AWS using its advanced Intel 18A process node, along with a custom Xeon 6 chip built on Intel 3 technology.

Top Companies in the Artificial Intelligence in Semiconductor Market

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD)

- Qualcomm Technologies, Inc.

- Alphabet Inc. (Google)

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Broadcom Inc.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Samsung Electronics

- Other Prominent Players

Market Segmentation Overview

By Chip Type

- Central Processing Units (CPUs)

- Graphics Processing Units (GPUs)

- Field-Programmable Gate Arrays (FPGAs)

- Application-Specific Integrated Circuits (ASICs)

- Tensor Processing Units (TPUs)

By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others

By Application

- Autonomous Vehicles

- Robotics

- Consumer Electronics

- Healthcare & Medical Imaging

- Industrial Automation

- Smart Manufacturing

- Security & Surveillance

- Data Centers & Cloud Computing

- Others (Smart Home Devices, Wearables, etc.)

By End-Use Industry

- Automotive

- Electronics & Consumer Devices

- Healthcare

- Industrial

- Aerospace & Defense

- Telecommunication

- IT & Data Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa