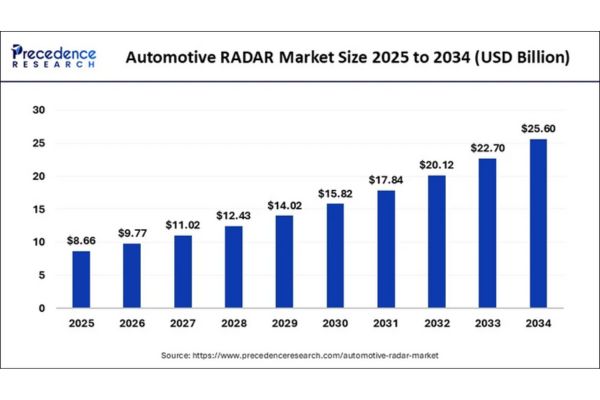

According to Precedence Research, the global automotive RADAR market size was valued at USD 7.68 billion in 2024 and is projected to attain around USD 25.60 billion by 2034, with a CAGR of 12.80%.

Automotive RADAR Market Key Points

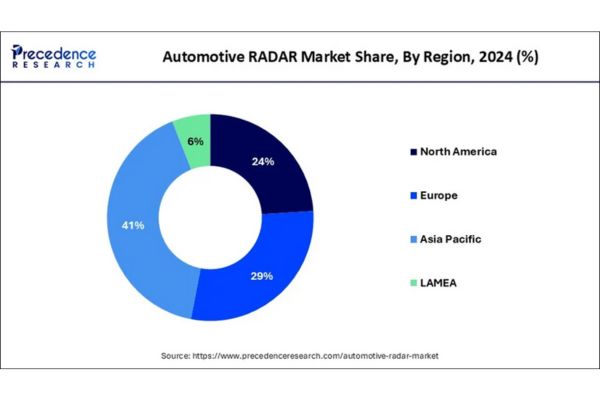

- Asia Pacific held the largest share of the global market in 2024, accounting for 41%.

- Europe is projected to record the fastest CAGR during the forecast period.

- By Range, the Short & Medium Range RADAR (S&MRR) segment captured the largest market share in 2024.

- By Application, the intelligent park assist segment generated over 52% of the revenue share in 2024.

- The adaptive cruise control (ACC) segment is expected to grow at the fastest CAGR over the forecast period.

Driving Safety and Automation: The Role of Automotive RADAR Systems

Automotive RADAR (Radio Detection and Ranging) systems are critical components in modern vehicles, enabling advanced driver assistance systems (ADAS) such as adaptive cruise control, lane departure warnings, blind spot detection, and collision avoidance.

These systems use radio waves to detect the speed, distance, and direction of objects in the vehicle’s surroundings, providing real-time data to enhance safety and automation. The technology is especially valued for its reliability in various environmental conditions, including darkness, fog, and rain, where other sensors like cameras or LiDAR may struggle.

The growing demand for safer and more autonomous vehicles is driving rapid adoption of automotive RADAR systems. Short and medium-range RADARs are widely used for functions like intelligent parking and lane change assistance, while long-range RADAR supports features such as highway autopilot and emergency braking.

As regulations tighten around vehicle safety and the automotive industry shifts toward electrification and automation, RADAR technology is expected to remain a foundational element in future mobility solutions.

What is the Role of AI in the Automotive RADAR Market?

Artificial Intelligence (AI) plays a transformative role in the automotive RADAR market by significantly enhancing the accuracy, efficiency, and adaptability of RADAR-based systems. AI algorithms process vast amounts of sensor data in real-time, enabling more precise object detection, classification, and tracking.

This is especially important in complex driving environments, where AI helps distinguish between pedestrians, vehicles, cyclists, and static objects. It also minimizes false positives and enhances situational awareness, contributing to the development of more reliable Advanced Driver Assistance Systems (ADAS) and autonomous driving features.

Moreover, AI facilitates sensor fusion, where data from RADAR is integrated with inputs from cameras, LiDAR, and ultrasonic sensors to create a comprehensive view of the vehicle’s surroundings. This multi-modal approach allows for better decision-making and predictive capabilities, such as anticipating pedestrian movements or reacting to sudden changes in traffic conditions.

As AI continues to evolve, its integration with RADAR technology is expected to drive the automotive industry toward higher levels of autonomy and safety.

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 25.60 Billion |

| Market Size in 2025 | USD 8.66 Billion |

| Market Size in 2024 | USD 7.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Frequency, Range, Vehicle Type, Application, Regional Outlook |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The market is primarily driven by increasing demand for vehicle safety features, government regulations mandating ADAS technologies, and the rising trend toward autonomous and semi-autonomous vehicles. RADAR systems are critical for applications like collision avoidance, adaptive cruise control, and blind spot detection.

Market Opportunities

The growing adoption of electric and autonomous vehicles, along with advancements in AI and sensor fusion technologies, presents significant opportunities for RADAR integration. Emerging markets are also adopting safety standards, creating new growth avenues for manufacturers.

Market Challenges

Key challenges include high system costs, complexity in integrating RADAR with other sensors, and potential interference issues. Additionally, achieving consistent performance across diverse weather and traffic conditions remains a technical hurdle.

Regional Outlook of the Automotive RADAR Market

Asia Pacific

Asia Pacific leads the global automotive RADAR market, with the region’s market size surpassing USD 9.99 billion in 2025 and projected to reach approximately USD 122.53 billion by 2034, growing at a robust CAGR of 33% during the forecast period. This dominance is attributed to increased purchasing power and a significant green revolution transforming mobility across countries like China, India, South Korea, and Japan. These nations are rapidly adopting smart mobility solutions to enhance vehicle safety and reduce environmental pollution.

The region’s flourishing automotive sector, coupled with government initiatives promoting electric and smart vehicles, further accelerates the adoption of advanced RADAR technologies in vehicles.

Europe

Europe is expected to exhibit lucrative growth in the automotive RADAR market over the next decade. The region’s expansion is primarily driven by government initiatives in countries such as Germany and the UK, aimed at reducing air pollution and decreasing accident rates.

Incentives for adopting electric and smart vehicles have triggered a surge in electric and hybrid vehicle sales, which are major applications for advanced vehicle safety solutions like automotive RADAR. Regulatory frameworks, such as the European Union’s mandate for short-range RADAR in automotive applications (specifically in the 77–81 GHz spectrum), are also propelling the market forward by making these technologies mandatory in new vehicles.

North America

North America is experiencing steady growth in the automotive RADAR market, driven by stringent vehicle safety regulations and the increasing integration of advanced driver assistance systems (ADAS). The National Highway Traffic Safety Administration (NHTSA) has imposed strict regulations regarding vehicle safety features, which has encouraged automakers to incorporate RADAR-based systems such as collision avoidance, adaptive cruise control, and lane departure warnings.

The growing consumer demand for safer and more comfortable driving experiences further supports the region’s market expansion.

Segmental Insights of the Automotive RADAR Market

By Range

Short & Medium Range RADAR (S&MRR) systems currently dominate the market, accounting for the largest revenue share and expected to maintain the fastest growth rate in the near future. These RADARs are vital for vehicle safety systems, providing functionalities such as lane change assist, blind spot detection, and park assist.

The segment’s expansion is further propelled by decreasing costs and the growing trend of integrating multiple RADAR units in each vehicle to enhance overall safety.

By Application

Intelligent Park assist is the dominant application segment, contributing nearly 52% of the overall market revenue in 2024. The heightened need for parking assistance to prevent collisions has driven the widespread installation of parking sensors in both new and existing vehicles.

Adaptive Cruise Control (ACC) is another rapidly growing application, fuelled by its popularity in major automotive markets and its recognition by regulatory authorities as a top safety improvement. ACC not only boosts vehicle safety but also advances the automation of driving, making it a cornerstone for future autonomous vehicles.

Automotive RADAR Market Companies

- Continental AG: A market leader, Continental supplies a wide range of radar sensors for advanced driver assistance and autonomous driving, with a strong global presence and high production volumes.

- Autoliv Inc.: Focuses on automotive safety systems, including radar-based technologies for collision avoidance and occupant protection.

- DENSO Corporation: Develops radar sensor systems widely adopted in various vehicle segments, supporting the spread of advanced safety features, especially in Asia.

- Delphi Automotive (Aptiv): Invests in research and integration of radar solutions for ADAS and autonomous vehicles, collaborating closely with automakers.

- NXP Semiconductors: Provides essential semiconductor components for automotive radar, enabling high-resolution imaging and sensor fusion.

- Texas Instruments: Supplies radar chipsets and signal processing solutions, supporting precise detection and robust performance in vehicle safety systems.

- Robert Bosch GmbH: A major innovator in radar technology, Bosch offers scalable, high-resolution radar sensors for both premium and mass-market vehicles.

- ZF Friedrichshafen: Delivers advanced radar systems that enhance vehicle safety and support autonomous driving, widely adopted by global car manufacturers.

- Valeo: Specializes in radar sensors for ADAS applications like collision avoidance and parking assistance, helping drive the adoption of smart vehicle technologies.

- Analog Devices: Supplies high-performance analog and mixed-signal ICs for radar modules, enabling precise signal processing for ADAS and autonomous driving.