Autonomous buses represent one of the most challenging platforms in the autonomous bus industry. In recent years, commercial interest has shifted towards roboshuttles and robotaxis, partly due to the complex operational design domains (ODD) of autonomous buses. The typical ODD for a bus requires interactions with a broad range of road users, including more pedestrians, cyclists, bus stops, passengers, and surrounding vehicles. The larger size of these buses, coupled with their intricate ODD, presents challenges similar to those faced by roboshuttles. In many forward-looking scenarios, autonomous buses are still viewed as fundamental urban infrastructure, which implies the necessity of substantial government support to advance these projects. This need for government involvement is one of the main reasons for the relatively slow progress in the development of autonomous buses. Despite these challenges, various autonomous bus projects worldwide are beginning to bring value to cities, with different bus sizes offering diverse scheduling solutions. This observation is among the findings discussed in the recent report by IDTechEx, “Roboshuttles and Autonomous Buses 2024-2044: Technologies, Trends, Forecasts”.

A decline in active players but varying statuses among different bus types

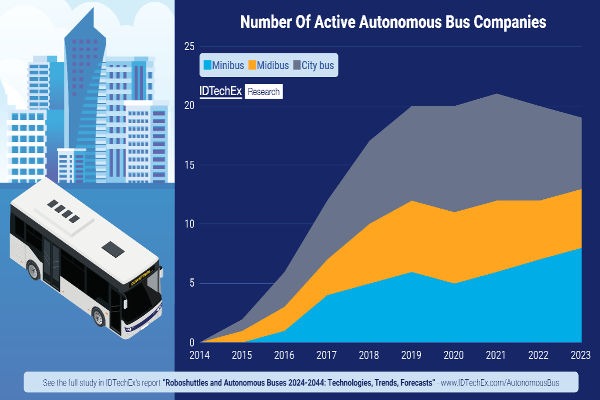

Over the past two years, the number of companies that IDTechEx have collected who are actively developing all types of autonomous buses has decreased by 18%, from 21 to 18. This decline is mainly due to a reduction in the development of city buses, driven by the slow progress of Level 4 (L4) autonomous systems and regulatory hurdles on larger vehicles. These challenges have made it difficult to validate city bus applications. Despite these challenges, two city bus projects are still moving forward with commercialization, supported by strong backing from various stakeholders, including the government. For example, in Seoul, Hyundai launched two L4 ADS (Automated Driving System) night bus services in December 2023, operating on a 9.8 km route from Hapjeong Station to Dongdaemun Station. This service has transitioned to a paid service in the first half of 2024, representing a huge milestone for the autonomous vehicle industry. The project benefits from the support of the local government, highlighting the role of collaboration in advancing such initiatives. In the UK, a longer autonomous bus route is in operation—a 14-mile stretch between the Ferrytoll park-and-ride in Fife and Edinburgh Park. This service runs frequently and can accommodate around 10,000 passenger journeys per week, demonstrating the potential of autonomous buses in public transportation.

In contrast to the decline in autonomous city bus development, the minibus sector has experienced a surge in activity. This growth is partly driven by support from local governments and the shift of some roboshuttle developers toward this faster, less commercially constrained market. Several minibus projects are now targeting specific commercial applications. For example, VW’s MOIA project in Germany focuses on city center coverage, while Aurrigo in the UK and Singapore is involved in passenger transport and cargo operations at airports. IDTechEx anticipates a gradual increase in the number of entities investing in autonomous buses, with minibusses and midibuses likely leading the way in commercialization over the next three years.

Players are transitioning from small-scale trials to commercial testing phases

Many autonomous bus companies have moved from small-scale trials to commercial testing phases in recent years. Given the current limitations of autonomous bus operations, particularly in achieving fully driverless functionality, large-scale testing may not be necessary or practical at this stage. Roboshuttles, designed to be small and deployed in large numbers, offer operational diversity within confined areas, making larger trials more feasible. In contrast, the higher capacity of buses means that fewer vehicles are needed per route, and the longer routes typically associated with bus operations introduce additional challenges. These factors make it less practical to deploy large fleets of autonomous city buses for testing purposes.

The IDTechEx report, “Roboshuttles and Autonomous Buses 2024-2044: Technologies, Trends, Forecasts”, offers an in-depth analysis of the current autonomous bus market, supported by historical sales data from 2019 onward. It also provides regional insights across China, Europe, the USA, and other regions, identifying the key challenges and opportunities facing the industry. By offering detailed forecasts for the next 20 years, the report aims to guide stakeholders as they navigate the evolving landscape of autonomous buses.