Growth in the electric vehicle (EV) market slowed in 2024 compared to predictions. China saw strong growth driven by greater plug-in-hybrid (PHEV) adoption, Europe’s EV market share remained similar to 2023 values, and the US saw only 7% growth in the first half of 2024 compared to 2023. IDTechEx’s research suggests that a key route to further market growth will be the entrance of lower-cost models.

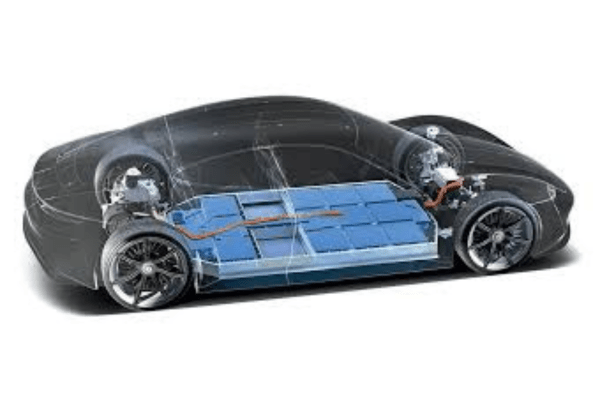

Given the battery is a huge portion of the cost of producing an EV, innovation here will be the biggest contributor to cost reduction. This has seen many turning to lower-cost battery chemistries like LFP (lithium iron phosphate). In fact, IDTechEx found that 33% of the global EV market used LFP cells in 2024. However, the trade-off comes in a loss in energy density (and hence vehicle range). So, what can be done at the pack level to balance these trade-offs?

Pack design enabling lower energy density cells

The volumetric energy density of NMC 811 cells is around 60% higher than LFP cells, however, the cost is around 20% more (per kWh). If it is assumed that the cells make up 30% of a battery pack’s volume (typical for earlier EV models), then for a 60kWh NMC 811 battery, it would take up around 300L. If the NMC cells were swapped for LFP, then the volume of this pack would rise to 490L for the same capacity. However, if a cell-to-pack approach was taken, eliminating modules and increasing cell size (e.g., BYD’s Blade battery), then the cell-to-pack ratio could be closer to 70%, at which point, the LFP pack’s volume would be 210L, 70% the size of the original NMC 811 pack, costing 20% less in cells and reducing pack material costs.

Of course, the same structure could be applied to NMC cells, leading to an even smaller battery pack, or one could increase the number of cells in the same space to increase vehicle range. The cell-to-pack approach has made the LFP pack much more viable as an option in terms of fitting the necessary battery capacity in a vehicle.

LMFP (lithium manganese iron phosphate) is coming to market and should occupy the gap between NMC and LFP in terms of both cost and energy density. Combining this with the already-mentioned pack design improvements will provide another option for automakers to balance performance and price. It could be that different trim levels use different battery chemistries (like Tesla has in Europe), with LFP used for the base models, LMFP for the mid-range, and NMC for the top range. IDTechEx’s new report, “Materials for Electric Vehicle Battery Cells and Packs 2025-2035: Technologies, Markets, Forecasts”, forecasts strong growth for LMFP cells, with it mostly eating into LFP’s market share, taking around 11% of the global EV market by 2035.

Options for pack improvement

Regardless of the cell-to-pack approach, automakers have been reducing the amount of materials that are used around the battery cells in a bid to increase pack energy density and reduce manufacturing costs. Optimizing components and materials such as the modules, cell interconnects, thermal management, sealants, adhesives, insulation, fire protection, and others can lead to a much more efficient and cost-effective battery design, regardless of cell chemistry.

Material intensity around the cells has decreased rapidly across packs with different thermal management strategies. Source: IDTechEx

Pack design will be critical for future solid-state batteries

Solid-state batteries are touted as the endgame for battery technology, boasting high energy density and improved safety. However, pack design will still be crucial to making them viable. Similar to the example discussed above, if we take a 30% cell-to-pack ratio for 60kWh using solid-state cells with 900Wh/L, the pack’s energy density would actually be very similar to the cell-to-pack LFP system.

Therefore, if solid-state cells were packaged similarly to older pouch cell battery packs, the energy density benefit may not be realized at the pack level. Safety is also a factor; even with solid-state cells potentially being safer, they will not be flawless, and fire protection and safety measures will still need to be taken. Therefore, for the potential future benefits of solid-state batteries to be viable, cell format and pack design will play a critical factor.

IDTechEx’s latest report, “Materials for Electric Vehicle Battery Cells and Packs 2025-2035: Technologies, Markets, Forecasts”, analyzes and forecasts market trends in cell and pack design to determine the demand for cell materials including nickel, cobalt, aluminum, manganese, phosphate, electrolyte, graphite, silicon, iron, copper, binder, separator, and conductive additives, as well as pack materials including aluminum, steel, copper, glass fiber reinforced polymer, carbon fiber reinforced polymer, thermal interface material, fire protection material, cold plates, coolant hoses, electrical insulation, and pack seals.