The global hydrogen energy storage market size was estimated at USD 17.59 billion in 2024 and is projected to e worth around USD 34.56 billion by 2034, growing at a CAGR of 7.01% from 2025 to 2034.

The global hydrogen energy storage market is rapidly emerging as a pivotal enabler of the clean energy transition, driven by the pressing need to decarbonize power systems, heavy industries, and transport sectors. the market is characterized by a growing convergence of policy mandates, technological innovation, and infrastructure investments, with Asia Pacific, particularly China, Japan, and India, setting the pace through aggressive national roadmaps and industrial-scale deployments. While compressed and liquefied hydrogen storage continue to dominate existing applications, material-based storage technologies such as metal hydrides and liquid organic hydrogen carriers (LOHCs) are gaining traction due to their enhanced safety, scalability, and energy density. Strategic developments in regions like Europe (salt cavern storage) and North America (underground hydrogen hubs) further reflect a global trend toward long-duration, flexible, and renewable-integrated energy storage solutions. As countries ramp up their hydrogen production capacities and integrate it into broader energy systems, hydrogen storage is expected to play a transformative role in ensuring energy resilience, grid stability, and a decarbonized industrial future.

Hydrogen Energy Storage Market Trends

Rapid expansion of hydrogen fueling infrastructure: As of end‑2024, there were 980 hydrogen refueling stations worldwide, including 550+ stations in Asia (≈ 200 in China alone).

Boom in hydrogen-powered vehicles: Global hydrogen fuel cell vehicle (FCEV) fleets grew by about 40% in 2022, reaching approximately 72,000 units on the roads.

Massive salt‐cavern storage deployments: The ACES Delta project in Utah is set to be the world’s largest hydrogen storage site by 2025, with a single cavern capable of holding over 3× more energy than the entire U.S. utility-scale battery capacity as of end‑2023

Surge in technology-specific projects: Over 55% of ongoing hydrogen storage initiatives now focus on advanced materials (e.g., metal hydrides, solid‑state), while compressed and liquid hydrogen systems remain widely deployed in industrial applications.

Flagship green hydrogen import terminals: Norway’s Hoegh Evi is planning an ammonia-to‑hydrogen import terminal to supply Germany, targeting $3–3.5/kg green hydrogen by 2027, versus $8–10/kg current average in Europe

First mover LOHC supply chains: Japan implemented the first international liquid organic hydrogen carrier (LOHC) chain with Brunei in 2020; these carriers now offer 60–70% efficiency, rising to 80–90% with heat recycling.

Strategic electrolyzer partnerships: Since 2021, Iwatani (Japan) and ITM Power (UK) have jointly deployed multi-megawatt electrolyzers for hydrogen systems across North America.

Policy-driven national goals: Under EU’s REPowerEU, the bloc targets 10 Mt domestic green hydrogen + 10 Mt imports by 2030; Germany aims for 10 GW electrolyzer capacity by 2030, backed by a €9 billion expenditure.

Scaling fuel-cell hybrid storage plants: The Calistoga Resiliency Center (California) couples hydrogen fuel cells and batteries, offering 8.5 MW output and 293 MWh storage, enough for 48 hours continuous power.

Technological Segmentation and Advancements

Hydrogen energy storage technologies fall primarily into three categories: compressed gas storage, liquid hydrogen storage, and material-based storage. Compressed hydrogen is currently the dominant technology, accounting for nearly 40% of the market share. This method involves storing hydrogen at high pressures and is widely adopted due to its simplicity and relatively lower cost. Liquefied hydrogen, though more expensive and energy-intensive to produce, offers higher volumetric energy density and is gaining traction in aerospace and heavy-duty transport sectors.

Material-based storage solutions, including metal hydrides and chemical hydrogen carriers, are still in developmental stages but show promise for compact and safe storage options. Another growing segment is underground hydrogen storage in geological formations such as salt caverns and depleted natural gas fields. Projects in the U.S. and Europe are already testing these solutions at scale, positioning them as viable options for seasonal or grid-scale energy storage.

Why Asia Pacific Leads the Hydrogen Energy Storage Market

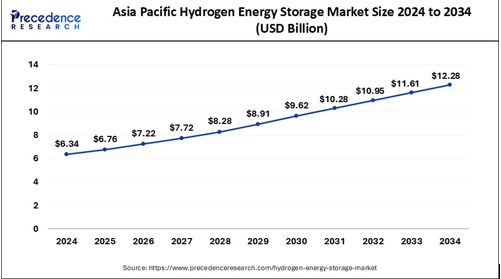

The Asia Pacific hydrogen energy storage market size reached USD 6.34 billion in 2024 and is predicted to surpass around USD 12.28 billion by 2034, growing at a CAGR of 6.86% from 2025 to 2034.

Asia Pacific’s dominance in the hydrogen energy storage sector is fundamentally underpinned by bold, well-funded national strategies that promote hydrogen as a cornerstone of future energy ecosystems. China, Japan, South Korea, India, and Australia have emerged as key actors, each tailoring national roadmaps to scale hydrogen infrastructure and commercialize storage technologies. China’s 2021 hydrogen plan is particularly aggressive, with multi-billion-dollar investments and support for over 1,000 hydrogen refueling stations. Japan’s early move in 2017 positioned it as a global innovator, followed by South Korea’s 2040 roadmap targeting millions of fuel cell vehicles.

India, as a rising clean energy hub, launched the National Green Hydrogen Mission in 2023, aiming to reduce dependence on fossil fuels and build green industrial corridors. With an initial outlay of USD 2.4 billion, the mission fuels demand for hydrogen storage technologies and supply chain infrastructure. Australia complements the regional momentum with its focus on green hydrogen exports, providing storage and liquefaction systems to support long-distance shipping.

Strong Government Policy Support

Asia Pacific countries, particularly China, Japan, South Korea, India, and Australia, have launched aggressive hydrogen roadmaps:

- Japan was the first country to adopt a national hydrogen strategy (2017). The Japanese government plans to install 200,000 hydrogen fuel cells in homes and have 800,000 fuel cell vehicles by 2030.

- China’s 2021 Hydrogen Industry Plan targets 100,000 hydrogen fuel cell vehicles by 2025, with massive investments in electrolyzer capacity.

- South Korea’s Hydrogen Economy Roadmap (2020) aims for 6.2 million fuel cell vehicles and 1,200 hydrogen refueling stations by 2040.

- India launched the National Green Hydrogen Mission in 2023 with a budget of ₹19,744 crore (US$2.4 billion) to create at least 5 million metric tonnes of green hydrogen per annum by 2030.

- Australia allocated AUD 2 billion to support green hydrogen development via the Hydrogen Headstart program.

Country-Level Factors and Market Metrics

| Country | 2022 Revenue (USD Mn) | 2034 Revenue (USD Mn) | CAGR (2022–30) | Key Strengths | Top Application (2024) | Growth Insight |

| China | 1,506.37 | 3,691.80 | 7.90% | Industrial hydrogen use, policy incentives, local tech production | Industrial (49.58%) | Strongest CAGR & highest share in APAC |

| Japan | 1,379.62 | 3,157.73 | 7.30% | Advanced hydrogen storage R&D, stationary fuel cells | Stationary Power (59.02%) | Tech-driven growth and exports |

| India | 1,184.14 | 2,472.04 | 6.50% | Green Hydrogen Mission, industrial decarbonization | Stationary Power (64.91%) | Strong material-based growth |

| South Korea | 806.7 | 1,585.00 | 5.90% | Hydrogen vehicles, infrastructure build-up | Stationary Power (61.56%) | Focus on fuel cell tech |

| Rest of APAC | 756.57 | 1,370.77 | 5.20% | Export initiatives (e.g., Australia), liquefaction storage systems | Stationary Power (63.05%) | Export-led and infra-oriented |

Hydrogen Energy Storage Market Segments

How is Hydrogen Energy Stored? Exploring the Key Technologies

When it comes to storing hydrogen energy, there isn’t just one way to do it. The most common method is compression, where hydrogen gas is squeezed into high-pressure tanks. This method is widely used because it’s relatively straightforward and has a solid infrastructure behind it—especially in hydrogen fueling stations and industrial settings.

Another approach is liquefaction, which involves cooling hydrogen down to extremely low temperatures until it turns into a liquid. This form takes up much less space than gas, making it useful for long-distance transportation and situations where compact energy storage is a priority. However, it requires a lot of energy to cool hydrogen, which can drive up costs.

Then there’s the material-based storage method. This is where hydrogen is stored by bonding with materials like metal hydrides or special absorbent materials. While this technique is still developing, it shows real promise in terms of safety and efficiency, especially for future energy storage systems in mobile or portable settings.

What Forms Does Hydrogen Take When Stored?

Hydrogen can exist in different physical forms when it’s being stored: gas, liquid, or solid.

Most commonly, hydrogen is stored as a gas, compressed in tanks. This method is already being used globally, especially in industries and transportation.

Storing hydrogen as a liquid means it’s kept at very cold temperatures, about -253°C. This method allows for more hydrogen to be stored in a smaller volume but requires specialized equipment and energy to maintain those low temperatures.

Then there’s solid-state hydrogen storage, which is less common but growing in interest. Here, hydrogen is stored within solid materials, which can be safer and more stable than gas or liquid forms. Although still mostly in the research phase, solid hydrogen storage could become more mainstream as technology advances.

Who’s Using Hydrogen Energy Storage?

Hydrogen energy storage isn’t just for one type of customer, it’s used by residential, commercial, and industrial end users, each with unique needs.

In the residential sector, hydrogen is being used in small-scale systems to provide both electricity and heat to homes. Countries like Japan are leading in this area, experimenting with hydrogen-powered home systems.

Commercial buildings, like offices and retail centers, are starting to adopt hydrogen for backup power and energy reliability. Businesses that want to reduce their environmental impact or operate in areas with unstable grids find hydrogen a clean and flexible solution.

The industrial sector is where hydrogen energy storage really shines. Industries that rely on hydrogen for processes, such as chemical production, metal refining, or glass manufacturing—are integrating storage systems to manage supply and use it more efficiently. This segment is currently the biggest user of hydrogen storage technology.

Where is Hydrogen Energy Storage Being Used?

Hydrogen isn’t just stored, it’s put to work. The two major application areas are stationary power and transportation.

In stationary power, hydrogen helps store energy for use when the sun isn’t shining or the wind isn’t blowing. It’s a valuable solution for renewable energy systems, acting as a long-term storage option. It’s also used as backup power in remote locations or critical infrastructure like hospitals and telecom towers.

In transportation, hydrogen is making waves through fuel cell electric vehicles (FCEVs). From personal cars to buses, trucks, trains, and even ships, hydrogen offers a zero-emission solution for heavy-duty transport. Countries like Germany, South Korea, and Japan are heavily investing in hydrogen-powered transport networks.