Rubix Data Sciences, a technology and analytics-based B2B risk management and monitoring platform provider, today announced, is pleased to announce its latest report Rubix Industry Insights—Automotive Components. The automotive components industry’s revenue is expected to cross USD 80.1 billion in FY2025, growing at 8% CAGR since FY2020. At present, its exports have touched ~USD 21.2 billion having grown at a CAGR of 10% since 2020. This report explores India’s role in the global automotive supply chain, the growth of EV components, government-led growth initiatives, and challenges like localization and workforce readiness.

One of the standout trends in the report is the doubling of the EV components industry’s contribution to 6% of total production in FY2024. Battery technology and powertrain systems are emerging as critical areas, comprising 45% of EV manufacturing costs. India’s EV market, supported by the EV 30 30 initiative, saw sales grow by over 76% CAGR from FY2020 to FY2024, with projections to maintain this momentum. The India Government’s focus on localization and self-reliance has led to significant investments in domestic manufacturing capabilities. Between FY2020 and FY2024, exports saw a 10% CAGR, reaching USD 21.3 billion, with the US being the largest market. Simultaneously, a trade surplus of USD 300 million in FY2024 underscores India’s strategic shift in global automotive supply chains.

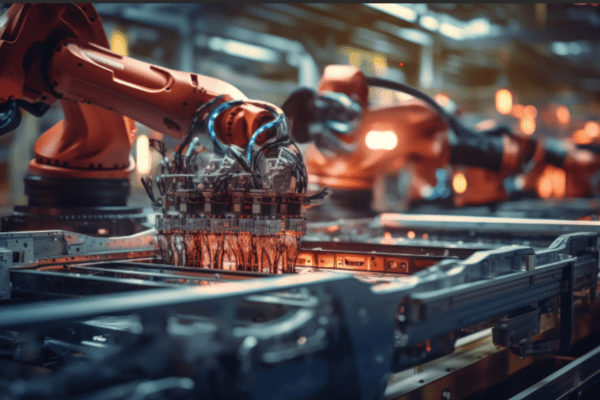

The report also focuses on investments in technology upgrades and modernization, with Indian manufacturers allocating USD 2.5 billion to USD 3 billion for capacity expansion and innovation. This aligns with the increasing demand for advanced components such as electric motors, Advanced Driver Assistance Systems (ADAS), and lightweight materials. The report forecasts a sixfold growth in the ADAS market, from USD 169 million in FY2023 to nearly USD 1 billion by FY2028.

Mohan Ramaswamy, Co-Founder & Chief Executive Officer, Rubix Data Sciences said, “India is rapidly becoming a vital player in the global automotive supply chain, thanks to robust growth in vehicle production, strong government support, and the unwavering commitment of component manufacturers—including a vibrant network of SMEs—to quality and innovation. We believe this momentum will position India as an indispensable sourcing hub for global OEMs, especially as the industry seeks reliable, diversified alternatives. Therefore, supporting SMEs in their modernization and growth will be crucial to sustaining India’s competitive edge on the global stage. By understanding the key trends, challenges, and opportunities in this sector, businesses can make informed decisions and capitalize on the potential of this dynamic industry.”

Policies such as the PLI scheme, PM e-Bus Sewa initiative, and the Vehicle Scrappage Policy are further helping industry growth. The PLI scheme alone aims to generate significant employment while fostering economies of scale in advanced automotive technologies. The Automotive Mission Plan 2047 sets ambitious targets, including a 50% export share of automotive vehicles and components by 2047, positioning India as a global manufacturing powerhouse.

Despite the encouraging trends, the industry faces challenges like increasing Chinese imports of EV components and adapting to stringent BS VII norms. Additionally, SMEs, which account for nearly 80% of the sector by volume, are grappling with the need to modernize and align with the EV transition. Rubix’s report emphasizes the urgency for innovation in lightweight materials, emission control systems, and advanced manufacturing techniques to maintain competitiveness. India’s automotive components industry is not only a key pillar of its domestic economy but also a growing force in global supply chains. Rubix Data Sciences’ report predicts a bright future for India’s automotive components industry, with investments in ADAS projected to grow sixfold to USD 1 billion by FY2028. The aftermarket segment is expected to reach USD 14 billion by 2028, driven by pre-owned vehicle sales and the growing vehicle parc, which is anticipated to surpass 340 million units by 2028.