2024 has been a tough year for the electric car market. After years of double-digit growth, electrification has hit troubled waters, particularly in Europe. Weaker EV demand, the growing threat of trade tariffs, and a highly uncertain political and regulatory landscape have left many questioning the future of the electric vehicle transition. However, not all electric vehicles are created equal. While the fully battery electric vehicle (BEV) has struggled in several key markets, its plug-in hybrid alternative (PHEV) has been experiencing a stellar year. IDTechEx’s in-depth research report, “Plug-in Hybrid and Battery Electric Cars 2025-2045: Technologies, Players, Regulations, Market Forecasts”, reveals how PHEVs are expected to grow by almost 75% in 2024 vs 2023 to over 7 million units. The report unpacks the regional trends behind this growth, exploring how the Chinese NEV market is driving this global growth in PHEVs, and outlining the key governmental and market factors underlying this trend. On the surface, PHEVs may appear to be an ideal compromise: zero emissions travel but without the same extent of reliance on expensive Li-ion batteries and backup ICE power to quell range anxiety. So, have BEVs had their moment in the sun, and is the future hybrid?

Global EV sales by drivetrain 2015 through to 2024 (expected sales). Much of the growth between 2023 and 2024 comes from an increase in plug-in hybrid electric vehicle (PHEV) sales. Source: IDTechEx – “Plug-in Hybrid and Battery Electric Cars 2025-2045: Technologies, Players, Regulations, Market Forecasts”

According to IDTechEx’s latest research, the answer is no, with BEVs expected to take 75% of the car market by 2045, with PHEVs claiming just over 5%. However, these figures do not tell the whole story, with IDTechEx expecting the PHEV share of new sales to peak by 2028, with the drivetrain enjoying significant successes in the short to medium term. IDTechEx’s report unpacks why PHEVs are so successful now, and the key market and policy drivers that will shift the market towards BEV longer term.

A question of cost and range

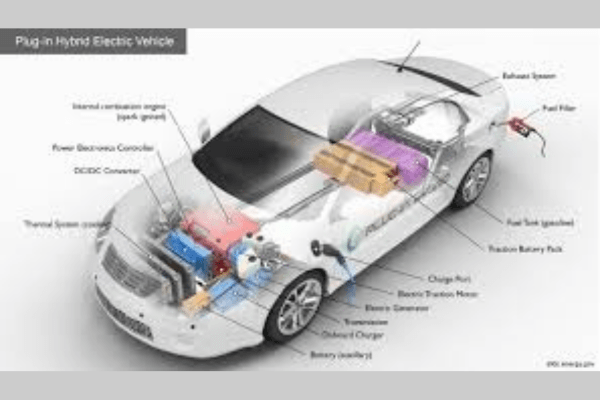

The single largest component cost of an EV is nearly always the Li-ion battery. Although economies of scale and new lower-cost cathode materials have allowed the cost of the battery to drop significantly over the past decade, it still represents a major obstacle to cheaper vehicles. PHEVs, by their design, contain a much smaller battery. IDTechEx’s extensive global database of EV sales indicates that the average weighted average BEV battery in 2024 was around 70kWh. While models vary, a typical PHEV has a capacity of anywhere from 5-25kWh. This much smaller battery lowers the cost of the vehicle dramatically. This smaller battery does not come at the expense of range; in fact, it is quite the contrary. Because PHEVs also contain a combustion-powered engine (which benefits from the developed petrol and gasoline refueling infrastructure), many argue that PHEVs actually reduce range anxiety. Lower cost, less reliance on expensive Li-ion batteries, and less range anxiety. If this is the case, then what is the drawback of PHEVs?

In the real world, environmental benefits are questionable at best and non-existent at worst

The core issue with PHEVs is that they do not provide consistent and significant emissions reductions over a comparable diesel/petrol ICE car. This research report by IDTechEx assesses some of the latest real-world findings regarding PHEVs and emissions, including a European Commission report that utilized on-board emission monitoring devices to compare real-world and WLTP emissions figures from PHEVs. They found that PHEVs had, on average, 267% higher real-world emissions than stated by test figures – which largely happens if drivers do not charge their PHEVs often enough, driving in ICE mode vs electric mode. These findings are spurring a policy change that means PHEVs will begin to detrimentally affect an OEMs CO2 fleet average (fleet average calculations and potential fines covered extensively in the report. In Europe, by 2035, all new car sales must be 100% zero emissions, and that excludes PHEVs.

In some regions, policy is not the core driver. In China, PHEVs and BEVs (which collectively constitute the bulk of the new energy vehicle (NEV) market) are treated like-for-like by government subsidies and grants. Major manufacturers like BYD have recently dramatically increased their model lineup of PHEVs, with many popular models offering both full battery and hybrid options. PHEVs have seen stellar performance in 2024, with the first half of the year seeing almost 22% of new car sales being PHEV (vs 10.7% in 2023). With a fairly low regulatory push to choose BEVs over PHEVs, what are the factors that will drive BEV adoption in China? IDTechEx research expects that Li-ion price decreases will drive the BEV premium (the amount that a BEV is more expensive than a PHEV) down over the next decade, to near parity. Once this price parity is achieved, the much cheaper cost of operation begins to be the dominant factor at play (electricity is much cheaper than petrol), although in less tough regulatory environments (e.g., the US and China), IDTechEx expects PHEVs to have a more sustained demand. The IDTechEx report, “Plug-in Hybrid and Battery Electric Cars 2025-2045: Technologies, Players, Regulations, Market Forecasts”, breaks down 20-year forecasts of sales by drivetrain and region, with unit sales, battery demand, and market value, giving a detailed assessment of the EV car market supported by in-depth analysis and commentary throughout.