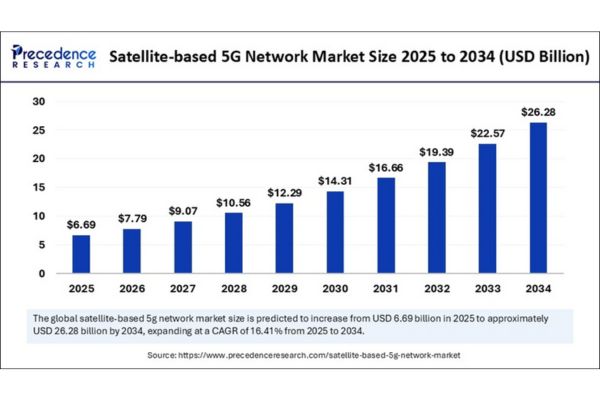

According to Precedence Research, the global satellite-based 5G network market size is expected to reach around USD 26.28 billion by 2034 from USD 5.75 billion in 2024, with a CAGR of 16.41%.

Satellite-based 5G Network Market Key Points

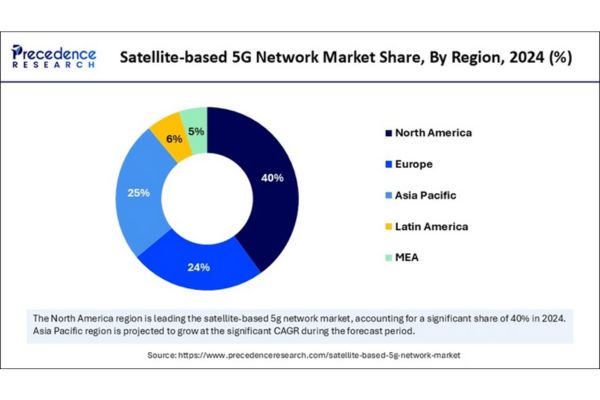

- In 2024, North America held the largest share of global market revenue at 40%.

- The Asia Pacific region is anticipated to experience significant CAGR growth from 2025 to 2034.

- By application, the telecommunications segment generated the highest revenue in 2024.

- By application, the emergency services segment is projected to grow at a strong CAGR during the forecast period of 2025 to 2034.

- By end use, the aerospace sector accounted for the largest revenue share in 2024.

- By end use, the maritime sector is expected to expand at a notable CAGR between 2025 and 2034.

- By technology, the low Earth orbit (LEO) segment dominated the market in 2024.

- By technology, the geostationary orbit (GEO) segment is forecasted to grow at a significant CAGR over the coming years.

- By infrastructure, ground stations led the market with the highest share in 2024.

- By infrastructure, satellite networks are expected to witness robust CAGR growth from 2025 to 2034.

How Is Artificial Intelligence Transforming the Satellite-Based 5G Network Market?

Artificial Intelligence (AI) plays a crucial role in enhancing the efficiency and performance of satellite-based 5G networks. AI algorithms enable intelligent traffic management, predictive maintenance, and real-time optimization of satellite communication systems. By analysing vast amounts of data from both ground stations and satellites, AI helps in dynamically allocating bandwidth, minimizing latency, and ensuring seamless connectivity especially in remote or underserved areas where traditional infrastructure is lacking.

Moreover, AI facilitates autonomous operations within satellite constellations, improving decision-making in areas such as network routing, signal interference mitigation, and resource allocation. It also supports anomaly detection and fault prediction, reducing operational downtime and improving system resilience. As 5G networks expand globally, the integration of AI into satellite systems is becoming essential for managing complex, distributed infrastructures and delivering reliable, high-speed communication services.

What Is a Satellite-Based 5G Network?

A satellite-based 5G network integrates satellite communication systems with terrestrial 5G infrastructure to extend high-speed connectivity across the globe. Unlike traditional 5G networks that rely heavily on ground-based cell towers, satellite-based systems use low Earth orbit (LEO), medium Earth orbit (MEO), or geostationary orbit (GEO) satellites to deliver coverage in remote, rural, or maritime regions where conventional infrastructure is limited or impractical.

This hybrid approach enhances network availability, ensures seamless connectivity during natural disasters or emergencies, and supports applications such as autonomous vehicles, smart agriculture, and global IoT deployment. As demand for uninterrupted, high-speed data continues to rise, satellite-based 5G networks play a critical role in bridging the digital divide and enabling truly global communication.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.28 Billion |

| Market Size in 2025 | USD 6.69 Billion |

| Market Size in 2024 | USD 5.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application Outlook, End Use Outlook, Technology Outlook, Infrastructure Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Are the Key Regional Trends Shaping the Satellite-based 5G Network Market?

North America

North America dominated the satellite-based 5G network market in 2024, accounting for over 40% of the global revenue share. This leadership is driven by significant investments in satellite infrastructure, supportive regulatory frameworks, and strong collaboration between satellite and telecom providers. The U.S. and Canada are at the forefront, leveraging AI-driven network management and deploying advanced satellite constellations. The region’s aerospace and defense sectors are also major adopters, further fueling demand for secure, high-speed satellite 5G connectivity.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region in the satellite-based 5G network market through 2034. Rapid urbanization, expanding digital infrastructure, and the need to connect remote and underserved areas are key drivers. Countries like China, India, and Japan are integrating satellites into their 5G rollouts, particularly to support IoT applications in smart cities and industry. Regional cooperation, government support, and innovative public-private partnerships are accelerating deployment and adoption across the region.

Europe

Europe holds a significant share of the global satellite-based 5G network market, underpinned by harmonized spectrum policies and strong support from the European Space Agency (ESA). European nations are investing in hybrid satellite-terrestrial 5G systems, streamlining licensing processes, and advancing low-latency satellite technologies. The region’s focus on integrating satellites with existing 5G infrastructure and supporting cross-border connectivity initiatives is expected to sustain steady market growth.

What Are the Key Segmental Insights Driving the Satellite-based 5G Network Market?

Application Insights

The telecommunications segment currently dominates the satellite-based 5G network market, driven by the global demand for robust, high-speed mobile connectivity—especially in remote and underserved areas. Satellite 5G enables seamless data transmission for smartphones, IoT devices, and streaming services where terrestrial networks are limited.

Additionally, the emergency services segment is projected to see rapid growth, as satellite networks provide critical, reliable communication for disaster response, search and rescue, and remote medical support.

End Use Insights

The aerospace sector leads the market in terms of end use, as airlines and aviation manufacturers increasingly adopt satellite-based 5G for in-flight connectivity and enhanced operational communications. The maritime industry is also emerging as a key user, leveraging satellite 5G to ensure continuous communication for vessels in remote ocean regions, supporting navigation, safety, and real-time cargo monitoring.

Other significant end users include oil & gas, mining, and agriculture, where satellite 5G supports IoT deployments in isolated locations.

Technology & Infrastructure Insights

Low Earth Orbit (LEO) satellites dominate the technology landscape, thanks to their ability to deliver low-latency, high-speed connectivity across vast and hard-to-reach areas. LEO deployments are accelerating, supported by advancements in beamforming and phased-array antennas.

On the infrastructure front, ground stations play a crucial role, acting as the vital link between satellites and terrestrial networks. Upgrades in ground station technology are making data transfer more efficient and reliable, while the integration of AI and machine learning is enhancing network management and predictive maintenance.

Satellite-based 5G Network Market Companies

Amazon: Through Project Kuiper, Amazon is building a large LEO satellite constellation to deliver global broadband and compete with other major providers, targeting both consumer and enterprise connectivity.

China Satcom: China Satcom is a key player in China’s satellite communications expansion, supporting the country’s 5G rollout and digital infrastructure, especially in remote regions.

Comtech Telecommunications Corp.: Comtech supplies essential ground segment technologies and solutions that enable seamless integration between satellite and terrestrial 5G networks.

Eutelsat: Eutelsat provides satellite broadband and connectivity services across Europe and Africa, investing in new constellations to support hybrid 5G networks.

GlobalStar: GlobalStar operates LEO satellites for mobile satellite services, supporting IoT, asset tracking, and emergency communications in areas lacking terrestrial coverage.

Hughes Network Systems: Hughes offers satellite broadband and hybrid networking solutions, helping extend 5G access to rural and underserved markets.

Inmarsat: Inmarsat specializes in satellite communications for aviation, maritime, and enterprise sectors, enhancing 5G mobility and remote communications.

Intelsat: Intelsat enables 5G backhaul and connectivity with its global satellite fleet, supporting enterprise and government clients.

Iridium Communications: Iridium provides global voice and data via LEO satellites, supporting IoT and 5G applications in remote and mobile environments.

L3Harris Technologies: L3Harris delivers advanced, secure satellite communications systems for government, military, and critical infrastructure 5G networks.

OneWeb: OneWeb is deploying a global LEO constellation to deliver high-speed, low-latency broadband, supporting 5G in remote and underserved areas.

SES S.A.: SES operates geostationary and medium-Earth orbit satellites, focusing on hybrid 5G deployments and global, low-latency connectivity.

SpaceX: SpaceX’s Starlink leads the market with its vast LEO constellation, providing global broadband and driving innovation in satellite-based 5G.

Telesat: Telesat is developing the Lightspeed LEO constellation to offer high-speed, low-latency connectivity for enterprise and government 5G applications.

Viasat: Viasat delivers satellite broadband for consumers, enterprises, and governments, supporting the integration of satellite technology into 5G networks.