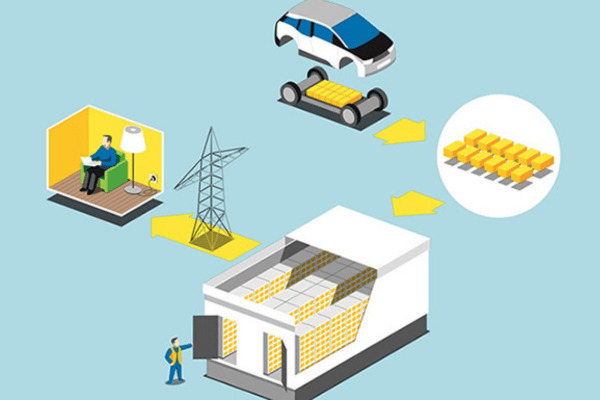

As suggested in their newly updated market report “Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies”, IDTechEx forecasts the second-life EV battery market to grow to US$4.2B in value by 2035, given the increasing availability of retired EV batteries over the coming decade. Li-ion batteries in electric vehicles may be used for 6-15 years, depending on the application and their degradation over time. Once these batteries reach a capacity, or State-of-Health (SOH), that is too low to facilitate the driving range requirements of the EV, these are retired. These batteries could be recycled to reclaim critical and valuable raw materials, which could be reintroduced into new EV battery manufacturing. However, these batteries could also be repurposed for second-life applications prior to recycling. This would maximize their value, extend their lifetime, and contribute to a circular Li-ion battery economy. Key second-life EV battery applications could include less demanding stationary battery storage or lower-power electromobility applications such as scooters or rickshaws.

Second-life battery repurposer activity

IDTechEx expects that repurposers in China are already scaling their deployments of second-life batteries, primarily for backup power applications, especially for telecom towers, given the growing demand for these technologies. Outside China, activity from 20 repurposers in Europe dominates the remainder of the global market, giving rise to a steadily growing volume of second-life batteries for commercial and industrial (C&I) applications in the region. Second-life batteries for these applications could include optimization of renewable energy self-consumption, peak shaving, and EV charging. However, key players in the US, including B2U Storage Solutions, Smartville, Higher Wire, and BBB Industries / TERREPOWER, have also continued to develop second-life battery technologies.

Repurposing costs and competition with first-life li-ion BESS

While IDTechEx has observed steady second-life EV battery market growth in Europe and the US, the reducing price of first-life Li-ion battery energy storage systems (BESS) has made it increasingly difficult for repurposers to commercialize and/or offer their systems at competitive prices. EV batteries will degrade over their first life, so repurposed second-life battery storage technologies will inherently be worse-performing than first-life Li-ion BESS. Therefore, second-life systems must be priced cheaper than first-life Li-ion BESS. Faster and advanced battery grading technologies that could, for example, be used while the EV battery is still in the vehicle could be one key method to reduce repurposing times and, therefore, costs. “Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies” from IDTechEx analyzes repurposing costs, including logistics, battery materials, and components, and the repurposing process itself, including battery testing, disassembly, and reassembly. Cost sensitivity analysis and discussion are also provided, identifying key bottlenecks in overall repurposing costs.

Future market outlook

The future of the second-life EV battery market will depend on numerous factors, related to policies and regulations, EV battery design and technology trends, advanced battery testing technologies, and collaboration between automotive OEMs and repurposers. For example, cell-to-pack (CTP) EV battery designs, while beneficial for improving energy density, could make disassembly procedures more expensive. Regarding policy, IDTechEx has observed a reasonable shift in terminology and recognition for repurposing batteries for second-life applications in the EU Battery Regulation. However, a greater emphasis could still be made to incentivize players to repurpose instead of prematurely recycling these batteries.

Repurposers will be inundated with overcoming such challenges, however, promising factors such as the emergence of business-to-business (B2B) battery marketplaces and the adoption of advanced end-of-life battery testing technologies, could expedite the acquiring and repurposing of retired EV batteries, respectively. These factors could, therefore, help repurposers scale their businesses and aid in second-life EV battery market growth. Ultimately, however, the availability of retired EV batteries will need to grow in key regions, such that OEMs can provide these batteries in larger volumes at lower costs to repurposers.

In their new market report, “Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies”, IDTechEx brings the reader a holistic overview of this market, including the following information:

Market forecasts and analysis

- 10-year market forecasts for the second-life EV battery market by installations (GWh) by region (Europe, US, China, RoW), application, and by value (US$B) for the 2022 – 2035 period. Overall EV battery availability and LFP EV battery availability forecasts are provided by region and type of EV for the 2020 – 2035 period.

Second-life EV battery market analysis

- Key conclusions for the second-life EV battery market, including challenges, drivers, and growth opportunities. This includes trends on technology cost, policy, battery design and performance, repurposing costs and automation, advanced battery testing and grading technologies, B2B marketplaces, business models, and revenue sharing.

- In-depth analysis on the second-life EV battery market, including funding by repurposer, key player activity, key automotive OEM activity, regional analysis and historical data of second-life batteries in Europe, the US, Africa, Japan, and Australia, and repurposer market share.

- Further granular analysis includes second-life batteries deployed (<2022 – 2024) by type of player (repurposer vs. automotive OEM) and by the depth of disassembly (pack-level, module-level, cell-level).

Company profiles, business models, revenue streams, technology applications

- 30+ company profiles, including key second-life battery repurposers, advanced end-of-life battery testing and grading technology developers/diagnosticians/second-life battery assessment players, and several Li-ion battery recyclers already participating, or which may look to participate, in the second-life EV battery market.

- Discussion and analysis of business models of second-life battery repurposers, their revenue generation mechanisms, in residential, commercial and industrial (C&I), and grid-scale battery storage markets. Key overview of second-life BESS supply/value chain and applications in key markets.

Techno-economic analysis vs first-life li-ion BESS, repurposing cost analysis and automation

- Techno-economic analysis of second-life EV battery storage technologies versus first-life, or new, Li-ion battery energy storage systems (BESS). Key comparisons in cost (US$/kWh), energy density, cycle life, and chemistries.

- Granular bottom-up repurposing cost analysis, comprised of data gathered from primary interviews with key second-life battery repurposers. Includes costs of logistics, battery materials, and components, and the repurposing process (testing or grading batteries, battery disassembly, and reassembly). Key cost sensitivity analysis is also included, factoring in key scenarios for repurposing cost reductions.

- Key discussion on emerging semi-automated battery disassembly projects and identification of key second-life EV battery repurposing process steps for automation.

EV battery trends and impacts on second-life batteries

- Discussion and analysis on EV battery design, chemistry, and technology trends and developments, and their impacts on the second-life EV battery market. This includes EV battery design standardization, cell-to-pack (CTP) and cell-to-chassis EV battery packs, larger cell form factors, battery electric vehicle (BEV) capacity, battery structures without glues and spot-welding, silicon anodes, advanced BMS technologies, and expected EV battery lifetime.

- Key and in-depth discussion on LFP and NMC EV battery chemistry considerations for second-life batteries.

Second-life battery assessment/diagnostics market

- Insights into key and supplementary tests that can be performed to assess retired EV battery suitability for second-life applications. This includes tests relevant for assessing battery health and degradation. Discussion on the advantages and disadvantages of various methods to model battery health and degradation. These include data-driven methods, e.g., machine learning / AI, physics-based models, combinations of approaches, etc. An overview of key players involved in second-life battery assessment and battery diagnostics is included.

- Key discussion and analysis on emerging business-to-business battery marketplaces, and battery testing stakeholder responsibility, and the impacts of sharing battery health and degradation data.

Second-life EV battery regulations

- Discussion and analysis on regulatory landscape for second-life batteries in key regions including the EU, US, and China. Further discussion on the EU Battery Passport, end-of-life battery data transparency, and extended producer responsibility (EPR) and impacts on player activity.