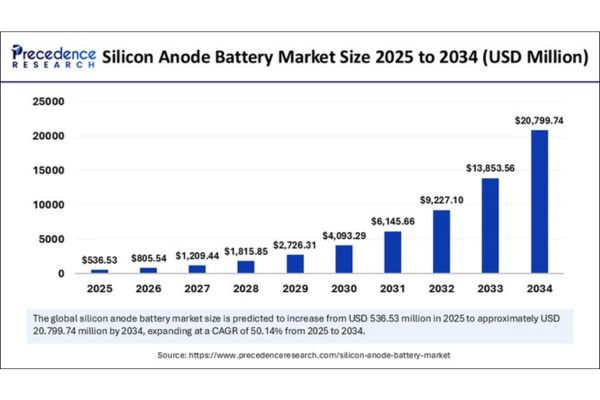

According to Precedence Research, the global silicon anode battery market size is expected to reach around USD 20,799.74 million by 2034 from USD 357.35 million in 2024, with a CAGR of 50.14%.

Silicon Anode Battery Market Key Points

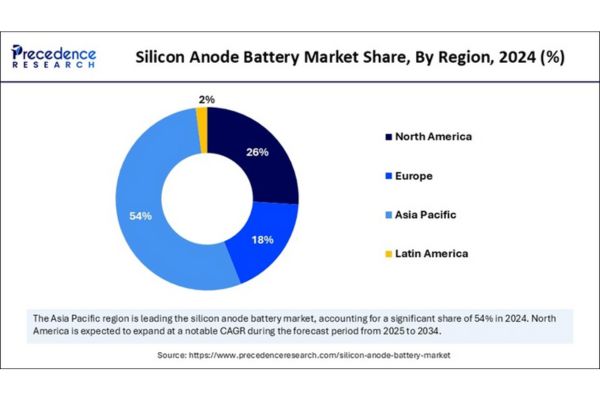

- In 2024, Asia Pacific led the global market, accounting for the largest revenue share of 54%.

- North America is projected to witness the fastest CAGR throughout the forecast period.

- Based on capacity, the <1,500 mAh segment held the highest market share of 47% in 2024.

- The 1,500 to 2,500 mAh capacity segment is anticipated to register the fastest growth rate in the coming years.

- By application, the automotive sector dominated the market with a 38% revenue share in 2024.

- The energy & power application segment is expected to grow at a notable CAGR over the forecast period.

Silicon Anode Batteries: Powering the Future of Energy Storage

Silicon anode batteries are an advanced type of lithium-ion battery that use silicon instead of traditional graphite in the anode. Silicon offers significantly higher energy density up to ten times more capacity than graphite making it a promising material for next-generation batteries. This allows for longer battery life and higher performance in devices such as electric vehicles (EVs), smartphones, and wearable technology.

The growing demand for high-capacity energy storage, especially in EVs and portable electronics, is driving the adoption of silicon anode batteries. Key advantages include faster charging, improved battery lifespan, and lighter weight. However, challenges such as volume expansion and cycle stability remain, prompting ongoing R&D efforts. As material science advances, silicon anode batteries are expected to become a key component in the future of energy storage.

How is AI Transforming the Silicon Anode Battery Market?

AI plays a vital role in accelerating the development and commercialization of silicon anode batteries by enhancing research, design, and production processes. Machine learning algorithms help researchers analyze complex data to predict the behavior of silicon materials, optimize battery composition, and improve cycle stability. This speeds up innovation by identifying the best-performing material combinations faster than traditional trial-and-error methods.

In manufacturing, AI is used for quality control, predictive maintenance, and process optimization, ensuring higher yield and consistent battery performance. AI-driven simulations also support the scaling of production while minimizing costs and waste. As the demand for high-capacity and long-lasting batteries rises, AI is becoming a crucial enabler in bringing efficient and commercially viable silicon anode batteries to market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20,799.74 Million |

| Market Size in 2025 | USD 536.53 Million |

| Market Size in 2024 | USD 357.35 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 50.14% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Capacity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The growing demand for high-performance batteries in electric vehicles, consumer electronics, and renewable energy storage is a major driver for the silicon anode battery market. Silicon’s ability to store significantly more lithium than graphite enhances battery capacity and energy density, making it ideal for next-generation applications. The push for longer-lasting and faster-charging batteries is further accelerating market growth.

Opportunities

There are strong opportunities in the integration of silicon anodes in EVs and wearable devices, as well as in grid energy storage. Advancements in nanotechnology and material engineering offer pathways to improve silicon’s performance and durability. Collaborations between battery manufacturers, tech companies, and research institutions are also paving the way for commercial-scale production and innovation.

Challenges

Despite its promise, silicon anode technology faces significant challenges such as volume expansion during charging, which can lead to structural degradation and reduced battery life. Manufacturing complexities and high production costs also pose barriers to widespread adoption. Continuous R&D is needed to enhance stability and cost-efficiency to fully realize the market potential.

Silicon Anode Battery Market Regional Outlook

Asia Pacific

Asia Pacific dominated the silicon anode battery market in 2024 and is projected to maintain its lead through 2034. The region benefits from a strong ecosystem of major battery manufacturers, raw material suppliers, and established electronics and automotive industries. Government support, substantial R&D investments, and robust supply chains further bolster its market position.

Asia Pacific’s proximity to raw materials and the rapid growth in electric vehicle and electronics production make it a global hub for both the manufacturing and consumption of silicon anode batteries. These factors collectively drive the region’s significant revenue share and continued dominance in the market.

North America

North America is expected to be the fastest-growing region for silicon anode batteries over the forecast period. This growth is fueled by increasing investments in advanced battery manufacturing technologies, government incentives for clean energy, and a rapidly expanding EV sector.

North America’s focus on developing domestic supply chains for critical battery components reduces reliance on imports and encourages innovation in battery technology. The region’s emphasis on smart electronics adoption and clean energy initiatives also contributes to the rising demand for silicon anode batteries.

Europe

Europe is set to experience considerable growth in the coming years, driven by stringent carbon emission regulations, rising adoption of electric vehicles, and strong government funding for sustainable technologies. Initiatives such as the European Union’s Green Deal and battery passport programs are encouraging manufacturers to adopt high-performance battery chemistries like silicon anode.

The ongoing development of gigafactories and clean energy storage infrastructure, along with a focus on ethical and localized supply chains, positions Europe as a key player in the global silicon anode battery market.

Silicon Anode Battery Market Segmental Insights

Capacity Insights

The silicon anode battery market is segmented by capacity into less than 1,500 mAh, 1,500–2,500 mAh, and above 2,500 mAh. The segment below 1,500 mAh led the market in 2024, largely due to its use in compact electronic devices such as smartphones and wearables that require moderate but reliable energy storage. These batteries offer enhanced energy density and performance at a competitive cost, making them appealing for small electronics manufacturers.

The 1,500–2,500 mAh segment is projected to grow at the fastest rate, driven by increasing adoption in mid-sized devices, electric bikes, and portable tools. Advances in battery technology are enabling higher capacity without sacrificing battery life or adding excessive weight, which is especially important for personal mobility and industrial applications.

Application Insights

In 2024, the automotive segment dominated the silicon anode battery market, reflecting the growing demand for high-performance batteries in electric vehicles. These vehicles require batteries with high energy density, fast charging capabilities, and long life cycles. The global shift toward electric mobility, supported by government policies and consumer demand for longer-range EVs, is accelerating the adoption of silicon anode technology in the automotive sector.

The energy and power segment is also expected to experience significant growth, driven by the increasing need for grid-scale batteries and renewable energy storage. Silicon anode batteries, with their high capacity and efficiency, are well-suited to support the transition to sustainable energy solutions.

Key Companies and Their Roles in the Silicon Anode Battery Market

- XG Sciences: Developed silicon-graphene anode materials enhancing battery life and energy density; operations ceased in 2022, with technology acquired by NanoXplore.

- Enevate Corporation: Focuses on silicon-dominant anode batteries offering ultra-fast charging and high energy density, mainly for electric vehicles.

- ENOVIX Corporation: Designs next-generation silicon-anode lithium-ion batteries for portable electronics and wearables with improved capacity and safety.

- Amprius Technologies: Leads in silicon nanowire anode batteries, delivering high energy density and fast charging for drones, aerospace, and EVs.

- Huawei: Develops silicon anode battery tech to enhance battery life and charging speeds in smartphones and mobile devices.

- OneD Material, Inc.: Specializes in silicon nanowire anodes compatible with existing battery manufacturing, targeting EV and high-performance markets.

- Nexeon Ltd: Produces engineered silicon materials for anodes, partnering with battery and automotive companies to improve EV battery performance.

- California Lithium Battery: Works on silicon-graphene composite anodes to boost energy density and lifespan for EVs, grid storage, and electronics.

- EoCell Inc.: Develops high-capacity silicon anode batteries aimed at EVs and renewable energy storage with a focus on cost-effective innovation.

- Group14 Technologies: Provides silicon-carbon composite anode materials to enhance energy density and charging speed for EVs and consumer electronics.