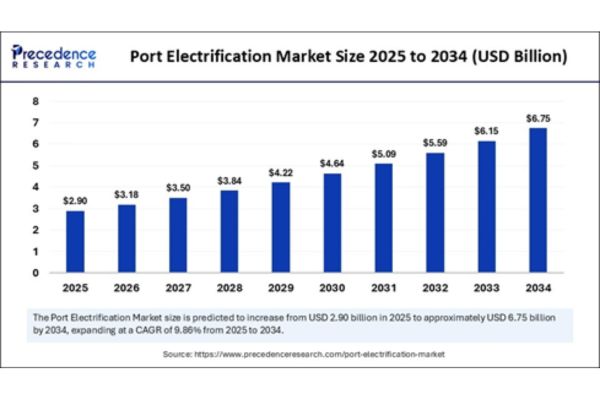

The global port electrification market size is evaluated at USD 2.90 billion in 2025 and is predicted to touch around USD 6.75 billion by 2034, growing at a CAGR of 9.86% from 2025 to 2034.

This growth is being driven by accelerating investments in green infrastructure, increasing pressure from climate-conscious stakeholders, and favorable government policies across major regions. Port authorities, logistics operators, and energy solution providers are rapidly aligning their strategies to capitalize on this transformation. The expanding role of electric mobility, smart energy systems, and digital infrastructure is reshaping the competitive landscape and redefining the standards for modern maritime trade.

What is Port Electrification and Why Is It Transformational?

Port electrification is the process of transitioning ports from fossil fuel-based operations to electricity-powered systems. This includes replacing diesel-run ships, cranes, trucks, and auxiliary equipment with electric alternatives such as shore-to-ship power systems, electric cargo handling equipment, energy storage solutions, and smart grid infrastructure. The goal is to minimize greenhouse gas emissions, reduce operational costs, and improve air quality in port-adjacent urban zones. As global supply chains grow more complex and environmentally accountable, electrified ports offer a cleaner, smarter, and more resilient solution to modern logistics challenges. It’s not just a technological upgrade, it’s a paradigm shift for the maritime industry.

What Are the Core Technologies Enabling Port Electrification?

Several breakthrough technologies are driving the adoption of electrified ports. Shore-to-Ship Power (also called cold ironing) allows vessels to plug into onshore electrical grids, enabling them to shut off diesel engines while docked—dramatically reducing emissions and noise pollution. Electric cargo handling equipment such as gantry cranes, reach stackers, and automated guided vehicles (AGVs) replace diesel variants, offering lower maintenance costs and cleaner operation. Battery Energy Storage Systems (BESS) help ports manage electricity demand spikes and support integration with renewable energy sources like solar and wind. Smart grid infrastructure digitizes power management, enabling real-time energy distribution, predictive maintenance, and better integration with external grids. Hydrogen fuel cell vehicles are also emerging as a viable option for long-duration, heavy-duty operations, offering faster refueling than batteries and fewer emissions than diesel. Lastly, ports are exploring microgrids and renewable generation to create localized, resilient energy systems capable of operating independently from national grids during disruptions.

Why Is Port Electrification Becoming a Global Priority?

Port electrification is becoming inevitable due to a combination of environmental, economic, and regulatory factors. Ports are among the largest contributors to localized emissions, producing significant amounts of CO₂, NOₓ, SOₓ, and particulate matter. These pollutants have a direct impact on the health of nearby populations and contribute to global climate change. Electrification significantly reduces these emissions, supporting international climate goals such as the IMO 2050 targets, which call for a 50% reduction in greenhouse gas emissions from international shipping by mid-century. Electrified operations also provide long-term cost savings due to lower fuel expenses and reduced equipment maintenance needs. Additionally, as cities push for cleaner air and investors prioritize ESG performance, ports must modernize to remain competitive and compliant. The convergence of regulatory mandates, technological readiness, and environmental urgency makes electrification not just beneficial, but essential.

What Are the Key Market Segments in the Port Electrification Industry?

The port electrification market is segmented by component, port type, and power source. In terms of components, key segments include shore power systems, energy storage units, power distribution infrastructure such as switchgear and transformers, electric cargo handling equipment, and digital control software. Shore power systems hold the largest share due to mandatory implementations in regions like Europe and California. Battery energy storage is rapidly growing, especially in ports aiming to stabilize grid loads and integrate renewables. Electric cargo handling equipment is expanding as port terminals move away from diesel-powered cranes and forklifts.

By port type, container ports dominate the landscape because of their high operational complexity and equipment intensity. Ro-Ro (roll-on/roll-off) ports are beginning to electrify loading ramps and vehicle transfer systems. Bulk cargo ports are slowly transitioning to electric stackers and conveyors. Inland and river ports, though smaller in scale, are innovating with modular solar microgrids and localized battery storage.

In terms of power sources, onshore grid electricity remains the primary supply, although its limitations in capacity and reliability have opened doors for hybrid systems. Renewable energy sources like solar and wind are increasingly being adopted as sustainable alternatives. Hydrogen fuel cells offer longer operating times and faster refueling, making them suitable for large vehicles and heavy-duty applications.

What Are the Regional Highlights of Port Electrification?

Europe leads the world in port electrification, driven by stringent policies under the EU Fit for 55 package, which mandates shore power availability in major ports by 2030. Countries like Germany, the Netherlands, Sweden, and Norway are early adopters, with ports such as Rotterdam and Hamburg becoming models for clean and connected maritime infrastructure.

North America, particularly California, is making rapid progress under the leadership of the California Air Resources Board (CARB), which has mandated zero-emission cargo handling equipment by 2035. The Ports of Los Angeles and Long Beach are pioneers in implementing shore power, electric trucks, and battery storage systems. Canada is also making strides, with the Port of Vancouver promoting shore power and green corridor development.

Asia-Pacific is witnessing the fastest growth, with China, Japan, and Singapore investing heavily in smart port technologies and clean energy systems. China’s ports are aligning with the nation’s 2060 carbon neutrality target by electrifying equipment and deploying solar installations. Singapore’s upcoming Tuas Mega Port is designed to be fully digital and electrified, integrating automation, cold ironing, and AI-powered energy systems.

India is emerging as a promising market with its Harit Sagar Guidelines, which promote electrified and sustainable port development. Major ports such as Mumbai and Visakhapatnam are implementing pilot projects focused on grid modernization and shore power installation.

The Middle East and Africa are in the early stages of port electrification but show strong potential. DP World in Dubai is piloting electric cargo systems, while several African ports are being modernized through global development funding. The region’s abundant solar resources make it ideal for microgrid-based clean energy systems.

In Latin America, countries like Chile and Brazil are adopting shore power solutions through government incentives and multilateral funding support. The Port of Valparaíso in Chile is a notable example, having implemented shore power connections for cruise ships.

What Are the Major Drivers Fueling Market Growth?

The rise of port electrification is being propelled by a combination of regulatory mandates, sustainability pressures, and technological advancements. Key drivers include government policies such as the EU Fit for 55, California’s CARB regulations, the IMO 2050 strategy, and India’s Harit Sagar Guidelines. These frameworks establish strict targets for emissions reduction and mandate infrastructure upgrades to facilitate clean energy adoption.

Investor demand for ESG-aligned assets is also catalyzing electrification. Ports that embrace sustainability gain easier access to green bonds, climate funds, and institutional capital. Additionally, advances in battery technology, automation, and renewable energy integration are making electrification more cost-effective and scalable.

Public pressure is also mounting, especially in urban areas where port emissions contribute to respiratory illnesses and environmental degradation. Cities are increasingly demanding cleaner, quieter, and safer port operations.

What Challenges Must Be Overcome for Wider Adoption?

Despite its many benefits, port electrification faces several obstacles. High capital expenditure is a major barrier, especially for smaller or developing ports. Installing shore power systems, battery storage, and electrified equipment requires millions in upfront investment. Many ports depend on public-private partnerships or multilateral support to fund these projects.

Grid capacity and resilience also pose challenges. Existing electrical grids may not support the heavy and fluctuating loads required by shore power systems or electric cranes. This often necessitates grid upgrades or the deployment of supplemental energy sources like battery storage and microgrids.

Another pressing issue is the lack of standardization. Different ports and ships use varying connectors, voltage levels, and communication protocols, making interoperability a challenge. Establishing universal standards is essential for seamless global implementation.

Operational disruption is another concern. Retrofitting existing ports for electrification without affecting ongoing logistics operations requires careful planning and phased execution.

What Are the Emerging Opportunities in the Port Electrification Ecosystem?

The next decade presents several exciting opportunities in the port electrification domain. One of the most promising is the emergence of Green Port-as-a-Service (G-PaaS) models, where third-party providers build and operate electrification infrastructure in return for recurring subscription fees. This reduces the financial burden on port authorities and accelerates adoption.

Microgrid deployments offer another high-impact opportunity, especially in regions with unreliable or underdeveloped national grids. These self-sufficient energy systems combine solar, wind, batteries, and digital control systems to provide stable and clean power for port operations.

Digital twins are also gaining traction. These virtual replicas of port infrastructure and operations enable real-time simulation of energy flows, equipment performance, and logistics scenarios. When integrated with AI, they provide actionable insights for predictive maintenance and energy optimization.

Additionally, electrification supports the deployment of autonomous logistics systems, including electric trucks, drones, and automated cranes, enabling seamless and fully digital port ecosystems.

Who Are the Leading Players in the Port Electrification Market?

Several global players are at the forefront of port electrification. ABB is a leader in shore power systems and smart automation technologies. Siemens offers integrated solutions spanning smart grid management, digital twin applications, and electrification infrastructure. Cavotec specializes in shore power connectors, cable management systems, and automated mooring technologies.

DP World is actively investing in electrified logistics terminals and clean energy corridors around the world. Enel X, the innovation arm of Enel Group, focuses on renewable integration and energy storage systems tailored for industrial-scale applications, including ports.

Port Electrification Market Top Companies

- ABB

- Siemens

- Schneider Electric

- Cavotec

- Enel X

- Alstom

- Prysmian Group

- GE Grid Solutions

- Eaton

- APM Terminals

- DP World

- Adani Group

What Regulatory Frameworks Are Shaping the Market?

The regulatory landscape for port electrification is expanding rapidly. The European Union’s Fit for 55 package mandates shore power at all major ports by 2030 and imposes carbon pricing for shipping. The International Maritime Organization’s 2050 strategy calls for a 50% cut in GHG emissions and pressures shipping and port infrastructure to transition to low-carbon technologies.

In the U.S., California’s CARB regulations are leading the way, requiring all cargo handling equipment and drayage trucks to be zero-emission by 2035. India’s Harit Sagar Guidelines outline a vision for sustainable port development with a focus on renewable energy, digitalization, and emissions monitoring.

These regulatory efforts not only enforce compliance but also unlock funding, drive innovation, and signal long-term policy certainty to investors.